Original URL: https://www.theregister.com/2014/03/31/a_canter_around_cleversafe/

How much data must you have before you need Cleversafe? If you have to ask ...

We could tell you who has enough, but then we'd have to kill you

Posted in Storage, 31st March 2014 07:58 GMT

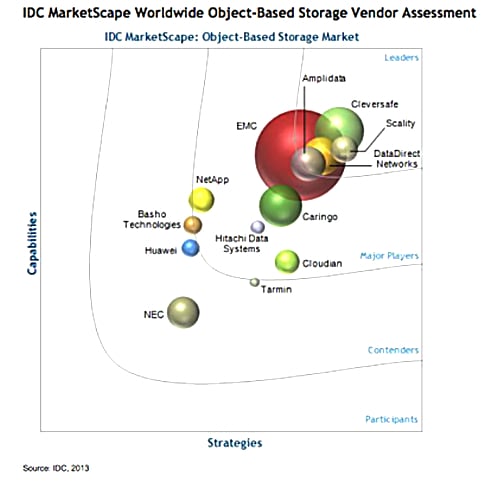

Analysis: Cleversafe is the leading object storage supplier, according to an IDC marketscape chart (see below). How did it get there?

We talked to Chris Gladwin, its founder, about how and why Cleversafe was started up and how it got where it is. The story starts in 2004 when he sold his second start-up, digital music supplier MusicNow, to Circuit City. It was then sold on to AOL "and became a huge success."

What next?

Gladwin says he thought that data storage volumes were going to skyrocket; the growing need for storage "was going to be massive". He said just extrapolate a 50 per cent growth rate for ten years and see where you get to. [A bit more than 57 times what you started with - Ed.]

Existing filer and block array storage technology couldn't scale up to petabyte-and-beyond levels: "buying three storage systems for protection, and using RAID (parity-based) wasn't right."

Gladwin had experience with wireless infrastructure and knowledge of telecoms; in particular the limitations of and move on from circuit switching. Before the Internet and IP telephony, telcos set up calls by dedicating a circuit to a call. Circuits were switched, inside switches so that there was a dedicated link between caller and callee.

This technology could not scale. It wasn't realistic to build switches with a million lines (circuits). So it was changed and we have packet-switching. Data is sliced up into packets and individual packets are routed across the Internet, being reassembled into a copy of the data at the far end of the link. It's a stateless method.

What if an analogous approach could be taken with massive amounts of data, with the storage system slicing up data into pieces, slices in Cleversafe terms, and storing these across nodes in the system; re-assembling the file whenever it was needed.

The Data IS the Network. No wait, other way round

That was the insight; treat data like a packet-switched network which stores the data after ingest instead of transmitting it across a network. The data persists and has state. Gladwin realised he could provide seed funding himself, talked to VCs, and set up a dev team in Chicago - based at Illinois Institute of Technology, recruiting masters and grad students. The team had three components to it:

- 20 per cent were storage experts

- 30 per cent came with telco networking experience, not storage networking

- 50 per cent "were brilliant young minds," grad computer science students. "These guys didn't know what they didn't know," and weren't held back by notions of what couldn't be done.

These people have developed Cleversafe's object storage technology, the dsNet system and its ClevOS software.

Gladwin wanted many nines of data reliability, telco reliability levels. At that time, 2004, this was a relatively rare thing for storage. Development took a long time with much prototype testing by potential customers; one a not-for-profit broadcast media museum. There was also much patent activity; with 150 awarded patents today and 450, perhaps more, in preparation. The first product was formally shipped in 2010.

The idea was to sell to customers with a petabyte or more of storage, and these were large and expensive systems needing direct sales or sophisticated partners. Why that big? Because Cleversafe's object storage technology systems get better as they get bigger while the mainstream vendors' competing products get worse as they get bigger.

Gladwin says that his target customer market overlaps the high-end of object storage competitor Scality's market but goes on to much higher scale. Cleversafe says its approach "delivers the powerful combination of analytics and storage in a geographically distributed single system, allowing organisations to efficiently scale their big data environments to hundreds of petabytes, and even exabytes, today."

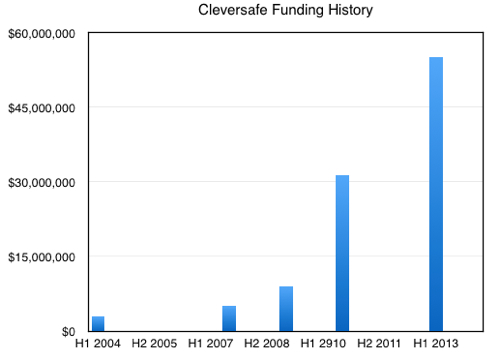

As development progressed VCs came in with several funding rounds; here's a funding history chart;

Look at that steady progression, with rising amounts invested in subsequent rounds; it looks like a classic 4-rounds to IPO pattern. With one round, the $9.01 million B-round, an interesting technology advisory board member arrived; Alan Wade, a former Central Intelligence Agency CIO. He retired from the agency in 2006 after spending 35 years there. A C-round took place in 2010, involving $31.4 million, and a new investor joined the participating original VCs, IN-Q-TEL, which says of itself: "We identify, adapt, and deliver innovative technology solutions to support the missions of the Central Intelligence Agency and broader U.S. Intelligence Community."

The Customers who Cannot Be Named

Gladwin talks of large customers who cannot be named. We reckon some of America's premier spookeries have bought Cleversafe systems. Total funding has passed $100 million but Gladwin won't say if the company is profitable or the number of customers it has or the number of product units units shipped. Our guess us that it isn't profitable yet but is close to that state. There are around 130 employees and all development is done in Chicago; there is no off-shoring.

The average Cleversafe customer has "well north of a petabyte" of Cleversafe storage deployed. Gladwin said that his potential customer base has become quite large:

"We estimate 6,000 customers will buy a petabyte of storage this year."

Some 28 petabytes of Cleversafe storage was deployed in 2013.

Cleversafe founder Chris Gladwin

Where does this leave us? We see a successful startup with funding there to take it to an IPO in 2015. It probably hasn't reached a $100 million/year revenue run rate but can see its way there. May last year saw Gladwin stepping back from the CEO slot to become the board's vice-chairman. In came John Morris as the new CEO and president, previously a Juniper EVP for world-wide field operations, with a brief to "focus on expanding Cleversafe’s go-to-market strategy and accelerating its current momentum in capitalising on the growth opportunity presented by the expanding global digital storage market."

New executives were appointed last year;, Jeffrey Giannetti joined from NetApp as SVP for global sales, with Deborah Phillips recruited from Cisco to be VP of marketing and communications. Michael Marchant came on board from Accenture to be VP and general counsel, having experience in intellectual property and global legal operations. You can scent the aroma of a company determined to head for the big time here, to sell its kit, market its kit, and protect its IP portfolio.

One thing: Gladwin runs 50-mile marathons and participates in adventure racing. He likes working on enduring, tough problems needing a lot of effort. Cleversafe needed that to get where it's going and we can't see anything ahead to trip it up. ®