This article is more than 1 year old

UK political parties fall over themselves to win tech contractor vote by pledging to review IR35

14 days till the General Election

Updated Controversial UK tax legislation IR35, coming to a private sector near you from the spring, is the latest tool being used to curry favour and win votes in the upcoming General Election in Britain.

IR35 shifts liability for determining a contractor's employment status to the employer, meaning organisations that use freelancers must decide from 6 April if a worker falls under off-payroll rules.

Those regulations state a contractor doing the same job as a full-time employee should pay similar tax and National Insurance contributions, despite not having access to benefits including holiday entitlement and sick pay.

Tech freelancers and recruiters are clearly against the legislation, and this week Harvey Nash claimed – based on a survey of 1,200 tech contractors – that mop-haired liar Boris Johnson could scoop up tech sector votes if only he withdraws the proposal to bring IR35 into businesses.

Matt Smith, Harvey Nash boss, said:

There are an estimated 4.6 million contractors in the UK. That's about 15 per cent of the entire workforce. These individuals are critical to the evolution and success of our economy, from the NHS to our thriving tech sector. With the potential impact of IR35 on their livelihoods, the survey shows it will be a major factor in their voting decision in December.

He added that if the political figures actually believe in "effecting real change after the election and driving new growth post Brexit, then the planned changes in policy in relation to self-employment in the technology sector will need to change".

The Lib Dems tried to win votes in the UK contractor community last week by vowing in the party's manifesto to "end retrospective tax changes like the loan charge brought in by the Conservatives, so that individuals and firms are treated fairly, and review recent proposals to change the IR35 rules".

Now Labour has pledged to stop IR35 in the private sector at an event organised by the Association of Independent Professionals and the Self-Employed (IPSE).

Bill Esterson, shadow minister for Small Business, said: "We absolutely can't see it rolled out into the private sector the way things are at the moment.

"We need to support the self-employed in this country. We need to make sure that our tax system is diverse so that it matches the needs of being self-employed and is also consistent with the risk that is taken."

This point will be well received by contractors, said IPSE director of policy Simon McVicker, but the intention to put up corporation tax and dividend tax will not.

"Now both Labour and the Liberal Democrats have heeded IPSE and the freelance community on IR35, it's time for the Conservatives to do the same. The five million-strong self-employed sector is vital to the economy and the country and its voice must be heard this election," said McVickers.

The Tory party has so far not mentioned IR35 in its manifesto (neither has Labour as yet) but we have asked the press office if this will change in light of electioneering from the other protagonists.

A bunch of banks – including Barclays, Lloyds and RBS – have warned contractors it will be ditching them ahead of 6 April so that they don't saddle themselves with a bill for contractor work from HMRC.

According to an internal memo from Shop Direct that we saw this week, it is asking hiring managers to complete an IR35 status determination for each contractor on its books and then "review the outcome". A status determination will then be sent to the the contractors.

Whilst we prepare for the new IR35 rules and work through our processes, we will not be amending any contractor terms (this includes day rates) or making any new placements or renewals which extend beyond 31 March 2020.

A source close to the business told us Mutuality of Obligations – the obligation of an employer to provide work and the employee to accept it, and something contractors have said HMRC has struggled with – remains an "acid test" in determining tax status.

HMRC's Check Employment Status for Tax tool – used to identify IR35 status – was recently updated to make it "clearer, reduce user error and consider more detailed information", the tax collection agency told us, saying it was "rigorously tested".

"It is accurate and HMRC will stand by the results, provided the information input is accurate and it is used in accordance with our guidance." Contractor bodies remain unconvinced.

Updated to add at 14.57GMT on 28 November 2019

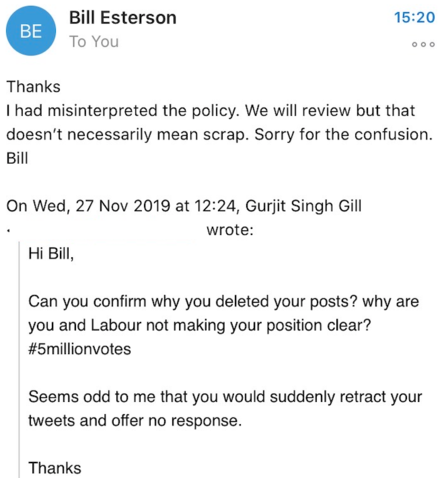

In classic politician style, Esterson has backtracked on his commitment to stop IR35, and in an email to Reg reader Gurjit Gill, seen by us, confirmed that Labour will not halt the introduction of IR35 in the private sector, but will "review it".

The Register has asked Labour to clarify its position.

Updated on 29 November at 10.51GMT to add

Despite repeated attempts, Labour has decided against giving us an official response. ®