This article is more than 1 year old

Two in five 'AI startups' essentially have no AI, mega-survey of nearly 3,000 upstarts finds

One pint of beer please, Mr Barman. I am 18 today, honest!

Like teenagers lying about their age to get served in a pub, tech startups are lying about their AI technology or skills to get VC money.

A full 40 per cent of tech companies describing themselves as "AI startups" had no evidence of any machine-learning tech "material" to what the firms actually did, a report by VC investor MMC Ventures found (PDF, page 99). And it surveyed to quite a few: some 2,830 companies responded. Here's how the report put it:

We individually reviewed the activities, focus and funding of 2,830 purported AI startups in the 13 EU countries most active in AI ... In approximately 60% of the cases – 1,580 companies – there was evidence of AI material to a company’s value proposition.

That's not saying much about the other 40 per cent, then.

It's an understandable fib. Fad-obsessed VCs are pouring money into "AI" and blockchain, so startups tune their pitches accordingly. VC investment in AI has increased 15x in five years, the firm estimated. MMC also found that a greater proportion of AI startups are highly valued – for now.

Buried in MMC's latest survey is a stunning stat: close to half of all AI startups in Europe don't use AI or machine learning in their business. The label is wrong, and for obvious reasons, they're not correcting it: https://t.co/o9m0p5xs8D

— Parmy Olson (@parmy) March 5, 2019

"AI companies' capital requirements can justify greater investment, given the longer cycles required to achieve develop a minimum viable product, the high cost of AI talent, and the larger teams required for complex deployments," we learn on page 112 of the tome.

Boring old business analysing marketing data? Just add AI. Yes, sir. I am over 18 and this is a real beard, and no, you cannot touch it.

The UK is home to a third of Europe's AI startups, MMC found, twice as many as any other country. More interesting uses for AI lie ahead – such as correctly anticipating demand or supply. But currently, one in four primarily serve the company's marketing department, crunching consumer data. "Modern marketing represents a sweet-spot for AI", the report said, meaning working on natural language processing to automate customer service.

Nine out of 10 such "AI" firms are B2B operations, and they cluster around where there's lots of data: the "health & wellbeing", finance, retail and media & entertainment sectors are particularly AI-curious. Reasons cited for AI development included "improved trading performance (financial services) or improved purchase conversion (retail); alternatives to automation that are impractical (healthcare) or expensive (finance)."

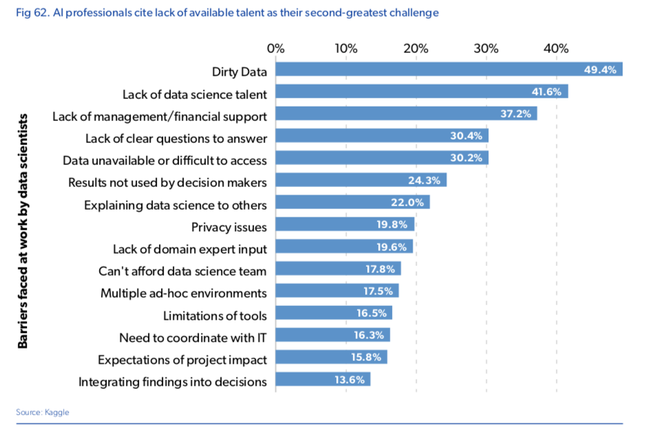

However, most developers confessed to grappling with AI to learn new skills. And "dirty data" was the developers' biggest peeve.

"A virtuous cycle has developed. Progress in AI is attracting investment, entrepreneurship and interest. These, in turn, are accelerating progress," reckoned MCC Ventures.

Here the definition of "progress" matters. Is progress measured by an increase in productivity? Or is progress simply more AI activity – an inflation of the AI investment bubble? We'll find out when the rubber hits the road. ®

Bootnote

MMC Ventures produced a very similar, boosterish report in 2017. It sells consulting services and material for AI wannabes: "Explore our companion document The AI Playbook, for a step-by-step guide to taking advantage of AI in your startup, scale-up or enterprise," gasps MMC.