This article is more than 1 year old

Wow, everyone loves our drives, says Seagate sitting on a pile o' cash

Disk arrays and flash still minor league stuff, though

Seagate's latest quarterly revenues benefited from an upsurge in disk drive demand – but still declined slightly year-on-year. The biz managed to bank a five-fold increase in profits, though.

Revenues for Seagate's first fiscal 2017 quarter, ending September 30, were $2.8bn, a 4.3 per cent decline from the year-ago's $2.92bn. The previous quarter's revenues were $2.7bn. Seagate had thought it would get $2.3bn revenues in the quarter and was clearly pleasantly surprised by the pumped up drive demand.

Net income was $167m; it was $34m a year ago and $70m in the previous quarter; good trend there.

Disk drive revenue was $2.59bn, while revenues from enterprise systems (disk arrays), flash and other things were $208m. The previous quarter numbers were $2.455bn and $199m respectively. The growth here is not exactly dynamic.

Seagate shipped 67EB of disk capacity in the quarter, 38.9 million drives. The year-ago unit ship number was 47.2 million and the prior quarter saw 36.8 million.

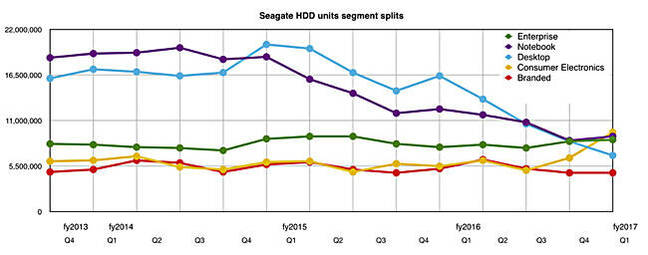

There has been a massive jump in Consumer Electronics drive shipments. Games consoles are now included in that category, which might account for part of it. Improved product manufacturing efficiency has perhaps enabled Seagate to participate more effectively in the market, by not having to avoid sectors where its margin needs prevented it selling low-margin product.

Seagate quarterly drive segment unit ship numbers

Within the enterprise segment, there has been a decline in mission-critical drive units and a rise in nearline, capacity-focussed unit shipments. There were 3.2 million mission-critical drives shipped in the quarter and 5.5 million nearline drives. A year ago, the numbers were 3.8 million and 3.9 million, respectively. With flash being the preferred medium for mission-critical data, this trend will likely continue.

Stifel MD Aaron Rakers says: "Seagate highlighted that its 8TB nearline HDDs continue to be the company's leading revenue SKU and demand for nearline was higher than previously forecast. Seagate noted that demand for nearline has accelerated, as cloud service providers are both deploying new systems as well as replacing existing HDDs, and Seagate expects that nearline exabyte demand will remain stable in the December quarter."

Average capacity per drive is on a steady ramp. It was 1.72TB this quarter, up from 1.67TB last quarter and 1.42TB the one before that.

Rakers says Seagate expects its next quarter revenues will be the same as this quarter. He says Seagate's enterprise and flash systems revenues could start to ramp up over the next few quarters, consequent on new product introductions.

All-in-all a good quarter for Seagate, but enterprise arrays and flash drives are still a work in progress. ®