This article is more than 1 year old

Win Sun, lose Sun: How Larry's bet on old-world systems hurt Oracle

AWS and Salesforce match up to Ellison's hardware

It's hard out there for hardware

Oracle’s hardware business barely grew in its most recent quarter – up one per cent. Revenue made from hardware has been up and down since 2010 but the underlying trajectory is down. As a percentage of Oracle’s business, hardware revenue has fallen, too – at 14 per cent of $1.3bn.

Today, Ellison and his new CEOs – Mark Hurd and Safra Catz – make various claims about being the largest cloud SaaS company as well as predictions about how Oracle will become number one in cloud.

Total cloud revenue for the second quarter was up 47 per cent from a year ago in the most recent quarter.

The rhetoric is a mix of Oracle top leadership's bullishness mixed with the fact Oracle’s applications, platform and infrastructure as a service had actually seen more growth than rivals.

Shaking that AaaS

Most application-as-a-service providers like Salesforce and NetSuite are growing at around 30 per cent a quarter. SAP’s apps-as-a-service business is growing at a similar percentage.

But when it comes to raw dollars, the bullishness doesn’t translate. For once, the giant that places a famous premium on profit and measures things in how much it makes is weak.

Oracle’s cloud business raked in $519m in Q2, but there are two problems with that figure. The first is that hundreds of millions of dollars are peanuts for this giant – a mere one to two per cent of total revenue.

Its legacy, on prem-software licences and maintenance for things such as Oracle ERP or database are still the things that count - making up more than 70 per cent of business.

New software licences earned $2bn and $4.7bn respectively in that quarter. Where does Oracle’s cloud business sit vis-à-vis other app-as-a-service rivals? Oracle grew and earned more than NetSuite, but was behind Salesforce and SAP, which are also adapting to the cloud era.

The other problem is more one of embarrassment for Oracle, because it shows the wrong strategic bet was made in 2010 in buying Sun – because, after all, cloud is now growing faster than hardware.

Or, put more bluntly, cloud is growing. The engineered systems sector is not.

It's amazing, that Amazon

First, let’s take AWS, the yard-stick on infrastructure and platform-as-a service.

Not only is Oracle’s cloud revenue peanuts next to that of AWS, but Amazon's web services business is actually making about the same as Larry’s engineered systems business – and it’s growing faster.

That’s an organic business, rather than one which Amazon would have had to spend money on – like, say, the Sun acquisition.

Amazon doesn’t break out the AWS revenue as a separate line in its spreadsheet, reporting it simply as “other”.

That “other” business was growing nearly as fast as Oracle, 37 per cent, in Amazon’s Q3 but making about the same as Oracle’s hardware systems products – $1.34bn.

AWS has now been valued as a possible $38bn business – making it so lucrative that it would be the subject of a bidding war should Amazon spin out the business, according to one analyst.

Amazon’s size is a product of its momentum, which was provided from having started first with AWS – in 2006.

How about software-as-a-service? Salesforce grew 29 per cent in its most recent quarter, again making around the same amount as Larry’s hardware business: $1.38bn.

Again, this has been organic growth for Salesforce in its core – not the product of customer acquisition through M&A.

Two years after AWS and nine years after Salesforce, Ellison was laughing off cloud as a passing fad. Two years after that, Ellison spent nearly $8bn swallowing Sun. His initial response was to sell more Oracle – flog Oracle systems and databases to those building clouds. Now, he’s come full circle, becoming a cloud service provider.

Every cloud service Oracle is now offering, all of which it claims are industry-leading, were launched in the years after following the Sun deal and following Mark Hurd’s 2013 claim of payback.

Oracle’s database-as-a-cloud service, Java cloud, storage cloud, big-data cloud, integration cloud and the rest came between 2012 and September last year.

It was in 2014, too, that Oracle finally rolled out a version of its flagship database capable of multi-tenancy, a cornerstone of Salesforce’s cloud service architecture.

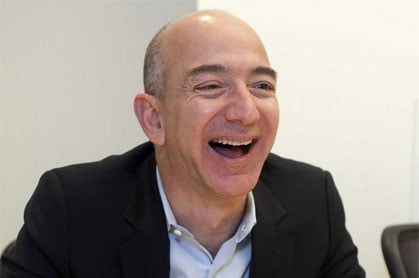

Bezos: the one Ellison should have been watching

Oracle 12c is now the foundation of Oracle’s elastic clouds and available to customers who want to build their own private clouds running on Oracle middleware.

The opportunity is there for Oracle hardware that may yet justify buying the Sun systems business.

Exadata has only been sold to a few thousand customers and the Oracle customer base is 300,000. That’s “opportunity”.

But sales are slow: Oracle is working hard to woo those who are happy buying everything from Oracle for the integrated technology stack or simplified purchasing and support.

It’s not like nobody saw something like AWS coming. Or even Salesforce – Larry was an early, founding investor in the latter. AWS launched in 2006, Salesforce in 1999. Cloud computing was already a “thing” by the mid-2000s.

Even Sun twigged to cloud computing – way back in 2004: its version was called “utility computing” and it charged $1 per hour. But Sun fumbled the execution and it killed the service in 2008.

Ellison isn’t the only one in enterprise IT to have overlooked the rise and importance of cloud computing, or to think it could either be contained or parleyed away.

Like SAP, Hewlett-Packard, IBM and Microsoft, Oracle is scrambling to make money as a provider of hosted cloud services by hosting other people’s data. Surprise – its fastest growth is in selling subscriptions to online versions of its software.

Unlike these others, however, Oracle’s CEO didn’t just avoid a burgeoning market – he closed his eyes more tightly.

Oracle cloud business could still haul past AWS, but it has handicapped and set itself back in getting there. ®