This article is more than 1 year old

Flash storage upstart SolidFire slurps $82m, intros Mini-Me arrays

Shrunken SSD and lower prices

Solidfire has introduced two smaller arrays that, over time, will replace their existing entry-level and mid-range offering. It's also picked up an extra $82m of funding.

The SF2405 and 4805 are two new products with smaller capacities and a lower starting price point so that customers can scale their storage at a more granular level. The company provides raw and effective capacity numbers – the effective ones being after deduplication and compression. We have:

- SF3010, 3TB raw and 12TB effective

- SF6010, 6TB raw and 21TB effective

- SF9010, 9.6TB raw and 35TB effective

The two new models feature:

- SF2405, 2.4TB raw and 8.6TB effective

- SF4805, 4.8TB raw and 17TB effective

They use the same 1U, 10-drive bay enclosure as the existing models.

When suppliers have a three product line-up and want to lower customer acquisition costs, they generally build smaller, less capacious and/or less powerful systems. Suppliers also have a separate need to replace products in the three-model range, with more powerful ones as technology improvements permit.

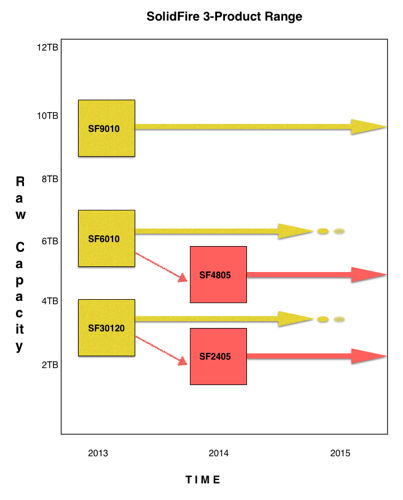

SolidFire appears to be trying to do both at the same time; lower acquisition costs with smaller systems and replace two of its existing models. The chart, which positions the existing and new systems in a 2D space delineated by capacity and time axes, shows this:

SolidFire Product Range with new models. Within 12 months the SF3010 and 6010 are expected to wither away.

The company has provided IOPS ratings - random/read/write with 4K blocks, for its systems. All the arrays except the SF9010 with its 75,000 IOPS, deliver 50,000 IOPS. The products are designed with clustering in mind, with configurations starting at four nodes and growing to 100 with linear scaling in performance.

SolidFire says customers can:

- Mix and match different node types within the same cluster

- Eliminate generational upgrades

- Use the most current and cost effective drive technology in the market

The software provides a guaranteed quality of storage data access service such that no one accessing host server can hog the systems resources and slow all other accesses down. This has appealed to cloud service providers, needing to deliver consistent service quality to their customers or tenants. It is also appealing to enterprises who are adopting private-cloud style storage provision.

Pricing and branding

A 4-node, 35TB SF2405 configuration will cost less than $100,000, which is, Solidfire marketing head Jay Prassl says, half the cost of the SF3010. We calculate this means the cost/effective GB of SF2405 flash is under $2.86. We're told every new SF node will deliver effective gigabytes at less than $3.

We should not misunderstand what SolidFire is doing here. This shift to a lower-priced and smaller node does not indicate a focus on the SMB market – these are enterprise-class systems. All that's happened is that the entry-point has gone down, every other aspect remaining the same.

The product naming seems straightforward:

- SF2405 - as it uses 240GB SSDs

- SF4805 - as it uses 480GB SSDs

We don't know what the "5" suffix means. We imagine that it hints at a coming SF9010 refresh.

A 9010 replacement would be called the SF9605 – if it used 960TB SSDs, and adhered to the same branding scheme. The 9010 actually uses 960GB SSDs now, and, if its refreshment downsized the component SSDS like the 2405 and 4805 have, then it could use 600GB SSDs.

But this strikes us, frankly, as an unlikely prospect. Surely it, as the high-end system, will use the same 960GB or larger SSDs and rely on better processors for a speed boost?

Funding need

SolidFire says its all-flash array (AFA) business is split 50:50 between cloud service providers and enterprises. In the latter it is competing directly with fellow start-up Pure Storage, Kaminario, recovering AFA ex-market leader Violin Memory, and all the mainstream server system and storage suppliers; Cisco, Dell, EMC, Fujitsu, HDS, HP, IBM and NetApp.

With their large customer bases, established channels and in-house AFA offerings, often inheriting existing data management facilities from their disk array lines, and customer caution and inertia, the mainstream suppliers have an advantage. Unless the startups can continually demonstrate significant price, performance and management advantages over the mainstreamers’ systems, they will find their market opportunity door closing.

That is why, we understand, backers are, almost literally, showering Pure Storage and now SolifdFire with grow-the-business-fast cash. There was a $31m C-round of funding last year for SolidFire. This latest $82m D-round takes total funding to $150m, a sum which is dwarfed by Pure Storage’s total of $470m.

Is it enough? Prassl says SolidFire’s latest funding is balanced and considered; the company is not, as it were, buying growth at any cost.

But grow it must, and quickly, before the opportunity door spans shut, pushed hard by EMC, NetApp and the other incumbents. This is a high-stakes growth race that SolidFire cannot afford to lose. ®