This article is more than 1 year old

Cisco: 'World head over heels for convergence'

Fluffy IT for fun and profit

Cisco Systems didn't necessarily want to be in the server racket. But a few years back, when the networking giant realized that converging server and storage networks would cut into its revenue streams. Therefore, to remain relevant - by which I mean to make money - Cisco could create converged infrastructure, including servers and networking together and partner for storage and hypervisors.

To try to get a sense if it made the right moves and to try to figure out where it needs to take IT next, Cisco commissioned three blind surveys this year to take the pulse among consumer and corporate IT users. Cisco hired a third party to do the surveys and talked to 2,600 data center managers in 13 different countries. The third report based on the survey data, which was released this week, focused on the challenges in the data center.

Cisco is happy to report that its big bet on convergence and virtualization in the data center seems to be paying off, says Craig Huitema, director for data center marketing at the company. Huitema recalls that when minicomputers and LAN servers first came into the data center and were hooked into mainframes decades ago, it forced people from different parts of the company and different parts of the IT organization to have to work together.

"We're seeing that happen again," says Huitema, referring to the virtualization of servers, desktops, storage and networks as well as the collapsing of the silos that used to separate these distinct parts of the IT organization. "There is always trepidation before the convergence of technology takes place. Then people realize they can cross-train and learn new skills, making themselves more valuable, and then it all works out."

Well, except if you are one of the IT people working on a platform with a skillset that doesn't make the leap.

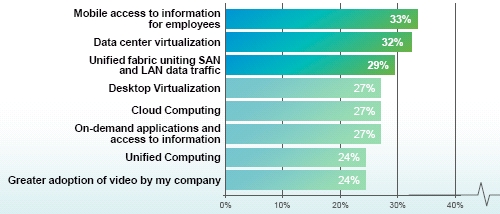

All the things that Cisco executives talk endlessly about seem to be on the Christmas list at data centers, which is probably good news for Cisco shareholders. When asked about what technologies and trends were most important for the data center in the next three years, here's how the top answers ranked:

Challenges facing data centers over the next three years.

Just like everyone was trying to figure out how to integrate PCs with back-end systems 20 years ago, now a lot of IT shops are trying to give mobile access to employees. And not even a bit ironically, just like consumers often had better PCs at home than they have at work, in the mobile computing world that has evolved over the past decade, a lot of consumers have access to better online services through their phones, handlhelds, and tablets from various service providers than they can get from their own IT departments running corporate applications. Corporate IT has been a laggard since the introduction of the PC, and the tables are probably not going to change back--unless you think of centralized cloud computing as a kind of revenge of the mainframe, as many people do.

Huitema says that a 32 per cent of IT managers interviewed for the survey said that improving agility and speed in deploying applications was the very top priority in the data center over the next three years, with 31 per cent saying that aligning capacity to needs (meaning virtualization and cloudy infrastructure). Some 19 per cent of respondents said that they needed to increase the resilience of their data centers, and only 17 percent said that reducing power and cooling were their top priorities. Power and cooling are generally issues for the largest data center operators and for companies that operate data centers in major cities where real estate is at a premium and it is hard to get extra power fed into a facility.

Drilling down into the servers, two thirds of respondents to the Cisco-sponsored data center survey said they had virtualized less than half of the physical servers in their sites, with 28 per cent saying that had virtualized half or more and 5 per cent saying that they were not sure. There are a lot of factors inhibiting server virtualization, and they all seem to have roughly the same concern across the IT managers polled.

About 20 percent said that security issues were the key inhibitor, while 18 per cent said the stability of the virtualized environment was a key problem. Troubles with creating operational processes around virtual machines were cited by 16 per cent of those participating in the survey, with management and administration being a problem for another 16 per cent; 15 per cent of respondents said that proprietary virtualization tools tied to applications inhibited them, and 14 per cent said that conflicts between different parts of the IT organization over who owned virtualized servers was the big problem.

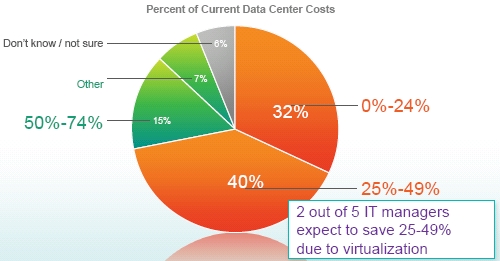

Cost savings are a big driver behind the server virtualization wave, of course. But how much do people think they are going to save? That depends on who you ask, as you can see from this pie chart:

Server virtualization: Expected savings vary wildly and widely.

Of course, Huitema conceded to El Reg that expected savings do not necessarily translate into actual savings. Every wave of transformation in the data center almost always gives a short-term total-cost-of-ownership benefit, but then before you know it, your capacity needs have pushed your IT spending up against the same old budget ceiling.

On the cloud front, 18 per cent of the respondents to the Connected World survey said they are already using cloud computing, with another 34 per cent saying they have plans, 26 per cent saying they are contemplating it. That leaves 10 per cent not doing it now and not planning to and another 12 per cent saying flat out that cloud computing doesn't work for them.

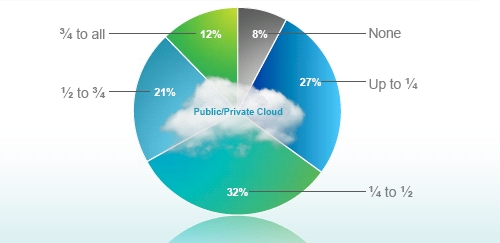

Some companies are thinking of going whole-hog for clouds over the next three years, and others are expecting merely to dabble. Here's the distribution of survey respondents by the share of their applications and data they expect to store on public or private clouds over the next three years:

Cloud usage for applications and data; you mileage also varies here.

Once again, plans rarely map to practice in reality. Hopefully Cisco can revisit these same 2,600 customers three years hence and then see how what they thought about convergence, server virtualization, and cloud computing ended up relative to plan. ®