Original URL: https://www.theregister.com/2014/10/06/arms_tentacles_spread_up_and_down_the_stack/

ARM spreads tentacles up and down the stack

Cloud-connected OS ramps up its IoT challenge another notch

Posted in Networks, 6th October 2014 09:02 GMT

Signs of slowdown in mobile device growth have driven ARM to expand aggressively into new areas for its processor IP – from servers to home equipment to the internet of things (IoT).

Its IoT strategy has been evolving over a couple of years, but in the past few weeks, the scale and ambition of that strategy has become clear.

The UK firm’s activities in new classes of microcontroller, in a new type of embedded operating system with cloud connectivity, and in would-be standards like Thread indicate that it will not be relying on its heartland licensing model to fend off Intel and Imagination/MIPS in the IoT, but will rather attempt to get its tentacles into every layer of the IoT stack.

ARM is putting together the pieces to offer its licensees a complete platform whose elements will span connected devices from tiny embedded sensors and "smart dust" to wearables.

In so many of these categories, the economics will depend on integrated, pre-tested inclusion of an entire stack, including OS and connectivity, and ARM is jumping ahead of Intel and others, at this early stage anyway, in delivering most of the key components.

This is all about building power bases, long before the market is really there. The mobile industry went through the process of consolidating around a small number of operating systems, processor platforms and connectivity options. Together, those three elements could support a huge diversity of devices and applications, but the real power to drive the market lay with the companies which controlled the OSes, the chips and the protocols.

Many assume the same process will repeat itself in the far more diverse and fragmented internet of things (IoT), and they are already positioning themselves to take the role that Google, Qualcomm or Ericsson had in 3G/4G. The playing field is wide open still, partly because there will be so many subsets of the IoT (many of which will use highly specialised underlying technology), and partly because there are more layers of the stack to consider.

There are chips at a far wider range of power and performance than mobile devices required, and those require different types of operating systems, which in turn create different developer ecosystems. And connectivity is not just about wide and local area, but personal area and body area. Nor is everything in the IoT actually internet-connected, so there must be support for "dumb" devices, non-IP protocols, peer-to-peer meshes and many other variations in how "things" link to one another and to the gateways and servers. Hence major players' need to have control or influence over a wider variety of technologies than in the relatively homogeneous cellular device sector.

Three key moves by ARM in the past weeks indicate its strategy is to cover as many bases as possible: its announcement of the mBed OS this week; its new additions to the Cortex-M microcontroller IP family; and its founder membership of the Thread group, a connectivity standards play led by Google’s Nest division.

The mBed OS, a new breed of RTOS

Last week ARM released a platform that bridged the gap between full processors and low end microcontrollers for IoT (internet of things) applications, with a high end implementation of its Cortex-M architecture.

The new M7 pushes the performance of a microcontroller almost into the realms of a microprocessor, nipping at the heels of ARM’s own Cortex-A designs and Intel’s Quark (see Wireless Watch September 25 2014). Now it has done the same for the operating system, upgrading its mBed embedded software platform to provide a new kind of OS, which sits between full smart platforms like Android and the ultra-low footprint real time OSs of the conventional embedded sector.

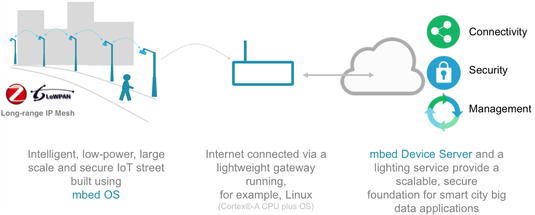

The firm said its new code will "provide a bridge between the protocols on IoT devices and the APIs used by web developers”. The embedded software will integrate with a server-side OS for cloud-based IoT management, networking and security. This middle territory is also targeted by Intel’s Quark and other chip designs, and will be important for IoT products such as gateways, which require more intelligence and processing power than traditional embedded gadgets.

The new mBed OS not only aims to add more functionality to a Cortex M-class microcontroller, but also provide a common platform that could become a de facto standard. Of course, in the process, ARM risks making enemies of the RTOS suppliers with which it has worked closely in the past – some of whom may renew their interest in alternative architectures.

However, the fragmentation of the embedded market among many real-time operating systems will hold back developers and limit the growth of a harmonised ecosystem, argues ARM – the kind of claims being made by many drivers of would-be standards up and down the IoT stack, such as Qualcomm’s AllJoyn for peer-to-peer discovery, or Google’s Thread for connectivity.

Most of the work to drive the IoT towards a single OS has been done on the higher performance devices, with Android the prime contender for intelligence connected devices like wearables and smart home appliances. But a host of RTOSs exist in the M2M world, which is now morphing in some areas into the fully con-nected IoT. One of them, it is always worth remembering, belongs to Intel, via its acquisition of Wind River, with its VxWorks RTOS and its real-time Linux implementations.

Get into mBed: The functions

ARM increasingly aims to build on its power in mobile processor IP by adding more and more software functionality and seeking to create a standard silicon/software platform that it controls.

Security has been an important focus of this strategy, and now it is greatly enhancing the role of its mBed platform, which begun life in 2006 as a way for developers to test embedded functions online and for students to experiment with programming their designs.

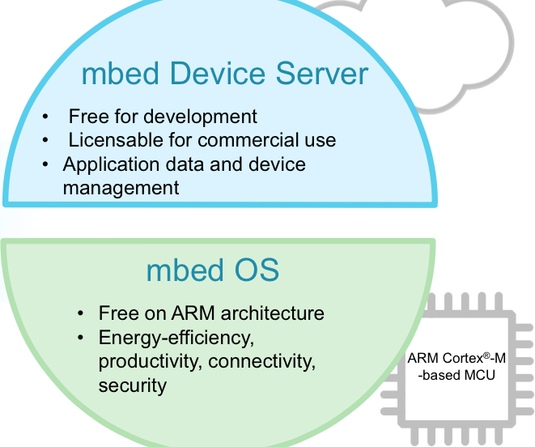

The new OS has a device-side element, running on Cortex M-based controllers, but the server-side mBed Device Server is processor-agnostic, and will run in virtualised environments and full processors, which could well be x86-based. This indicates the increasingly complex balancing acts ARM will have to achieve between keeping its broad base of partners united around a single architecture, with limited conflicts of interest; and seeking to push its software efforts across a multiplatform IoT. In smartphones, this balance was simple, since other processor designs had such a small share of the space – the same is unlikely to be true in the more diverse embedded sectors.

The operating system, which also incorporates the critical IoT activities of security and device management, is free for small scale use and prototyping but there will be an undisclosed royalty for large commercial public or private cloud services. It will be supplied as open source code that users can modify under an Apache 2.0 licence, apart from some advanced features, which will be provided in binary form. The OS will be made available to ARM’s partners and developers in the fourth quarter, and should appear on products early next year. Existing M-class controllers can be upgraded to run the OS, if they have the capability.

Conflicts of interest in the ARM ecosystem

There are about 17 embedded OSs available now, some of which are plumping themselves up to move higher up the IoT layers, such as Micrium (this specialist firm recently announced an end-to-end IoT strategy). Microsoft has two of its own, but of course, as in other software areas, the big growth is in open source. Almost half the platforms are Linux-based, the most widely used being FreeRTOS, according to EETimes.

It will be vital, of course, that ARM converts a large proportion of its existing base to its new designs, whether current microcontroller licensees, or CPU customers which are also making the move into the IoT, like Qualcomm. Most of the firms publicly pledging support for mBed OS were existing clients, including Atmel, CSR, Farnell, Freescale, IBM, Marvell, Megachips, Multitech, Nordic Semiconductor, NXP, Renesas, Seecontrol, Semtech, Silicon Labs, Stream Technologies, ST, Telenor Connexion, Telefonica, Thundersoft, u-blox, wot.io and Zebra.

It is notable that Broadcom is missing from the list, but also that ARM has secured some strong server-side supporters, notably IBM and Salesforce.com, which have committed to ensure their applications can connect to mBed servers to access the data from the "things".

Richard Barry, founder of the firm which developed FreeRTOS, told the journal that ARM’s mBed OS move was "analogous to its compiler strategy where it invests heavily in free compilers and also promotes its own heavily. ARM is full of contradictions... It both wants to enable processors and dominate the tools market at the expense of its ecosystem." The breadth and functionality of an OS’s runtime software and tools will be critical, and this is an area where Wind River has been active for years.

The Intel unit will surely be a significant barrier to ARM’s plans for IoT domination, since it combines a venerable real time platform, whose ecosystem and tools base has been steadily enriched over the years, with being an important weapon in Intel’s armoury.

And of course, Intel is as desperate as ARM to offset stagnating revenues in traditional markets (in its case, PCs) with a leading position in the IoT.

And Imagination, which now owns the MIPS processor cores, is also making a big play for the IoT, and knows this will need to include extensive software. It recently announced FlowCloud, a device and cloud platform for the MIPS cores.

The broader ambition’s of ARM’s IoT group

The mBed OS is the first full product from ARM’s new IoT group, whose overall goal is to "accelerate the pace of IoT uptake”, as its general manager, Krisztian Flautner, put it. "We are in the early phases of figuring out what the ecosystem needs and these are the first few elements we have identified,” he told the ARM TechCon event where the platform was unveiled. However, he was secretive about further elements of the unit’s roadmap. ARM describes the IoT division as “a long-term play for us that cuts across all our verticals as well as making money in its own right”.

The division has been largely built around the acquisition of Sensinode a year ago. That deal is proving a highly strategic one for ARM, and it has provided the cloud aspect of mBed OS, while the device aspect was developed in-house. Sensinode’s main focus has been on security and connectivity for microcontroller IP and it has also built protocols based on COAP (Constrained Application Protocol), which enables connected devices to talk to cloud-based servers and is included in mBed OS.

The Finnish firm has also been a contributor to the IETF, ZigBee IP, ETSI and OMA standardisation efforts. ARM has made the code for Sensinode’s NanoStack and NanoService M2M offerings available for evaluation through its mbed project, which lets engineers test products online.

That Sensinode technology is also likely to be feeding significantly into the specifications being developed by the Thread group, of which ARM is a founding member (the Finnish company has been a major contributor to the 6LoWPAN standard on which Thread is based).

Indeed, Thread may prove an important area where ARM can influence other aspects of the IoT platform, teaming up with powerful co-founders like Google/Nest and Samsung.

However, as with the OS, this entails making choices that may alienate some customers or partners, as seen in the connectivity options in mBed OS. It supports both IPv4 and IPv6 and its chosen protocols are WiFi and Bluetooth, along with 6LoWPAN and Thread. It supports 802.15.4 for both 6LoWPAN and ZigBee, but the latter seems very much sidelined in the connectivity priorities, while another Thread rival, Z-Wave, is excluded altogether. Also supported are TLS/DTLS, COAP, HTTP, MQTT and Lightweight M2M – plus Wi-Fi, cellular and Bluetooth Smart for networking.

All across the IoT, companies will be making these choices, and striking their own balance between all-inclusiveness, and promoting their own favoured technologies. The risk is, there are so many efforts, at various layers, to harmonise the different network, software and SoC choices targeting the IoT, that the industry risks fragmentation of the standards themselves. The ARM-Intel showdown is poised for a whole new scale of confrontation.

Copyright © 2014, Wireless Watch

Wireless Watch is published by Rethink Research, a London-based IT publishing and consulting firm. This weekly newsletter delivers in-depth analysis and market research of mobile and wireless for business. Subscription details are here.