Original URL: https://www.theregister.com/2014/01/17/ten_bitcoin_miners/

MANIC MINERS: Ten Bitcoin generating machines

Crank out those coins: A selection of tools for the new Gold Rush

Posted in Personal Tech, 17th January 2014 10:00 GMT

Product Round-up Bitcoins are either the new bubble economy or the future of online commerce. It’s not the first time anonymous e-money has been tried – ask Mondex – but Bitcoin does seem to have traction.

There are things you might want that you can buy with it, such as Tesla cars and Virgin Galactic trips to space. Zynga has announced that it will take Bitcoin for in-game payments, and there is a host of things you can buy through Bit Premier.

So, if you want to get into mining - perhaps you have some rack space doing nothing - you need to know what is on the market.

This is an ambitious article. It aims to tell you what is available and what it costs. In any other market that’s reasonable, but here products go in and out of stock constantly, driven by an erratic supply chain, particularly for chips. Prices reflect the value of Bitcoins, prices of rival hardware and the availability of that rival hardware. And much of this is shrouded in truths, half-truths and lies. Even more secretive is the company 21e6 which has raised $5m to build ASICs it will only use itself.

Comparing the miners starts with understanding what it takes to make a Bitcoin. Please forgive any over-simplification. Briefly, there is an algorithm to work out what is the next Bitcoin to be mined. Solving this requires a number of hashing operations. How many depends on how many coins have been minded previously so it’s an increasing level of difficulty. Initially this could be done with moderately specced PC but as more coins got mined this moved to using code, which took advantage of the super-fast graphics processors on video cards and then to dedicated hardware: ASICs designed purely to mine Bitcoins. Even these have evolved from homebrew to large technical teams.

If the bottom falls out of the Bitcoin market, all that equipment is useless. There is no other purpose to which it can be put. The processing is immense. While you can’t directly link mining hashes with FLOPS, it has been a couple of months since Bitcoin mining passed 1019 petaflops, or roughly the computing power of all the other computing tasks in the word - not allowing for what might go on in the NSA and GCHQ.

Which is where this round-up comes in. What hardware should you buy? How much money will it make and how easy is it to run?

How lucrative the process is depends not only on the cost of the hardware but the time you have to tend it, how stable it is and, crucially, how many hashes it can do for a given time and the cost of the electricity to do this. The value of coins often drops below the cost of the electricity used to make them. Although this of course depends on what you pay for your hosting. Data centres in places with cheap electricity, notably geothermally rich Iceland can become very attractive.

The costs need to be balanced against the increasing global difficulty of creating a coin against all the other people who are doing the same thing. It’s an arms race of processor design against the rising difficulty. Newer, faster processors are more expensive but stand a better chance of producing Bitcoins against the rising difficulty, and are more power efficient. Power consumption is generally rated in Watts (W) rather than KW/h and processing in hashes per second, expresses as Gigahash (GH/s), Terrahash (TH/s) and even Petahash (PH/s), especially when looking at global figures. There is are a number of calculators to help.

A further level of complication is that the value of what you are producing is incredibly variable. Bitcoin value in terms of hard currencies are wont to fluctuate by 10 per cent or more a day. On 4 December, one coin was worth over $1,100, two days later it was under $700 and two days after that back at $900. You can see values double and halve almost weekly. Some hardware is bought in Bitcoins but there has been a trend to dollar pricing, even from European vendors.

This round up is a guide, a good starting point. You should be wary of a plethora of sites which are selling Bitcoin mining hardware and which don’t have a buzz about the products on the Bitcointalk forum. The business is full of scammers. In general the nastier the website the more likely the manufacturer is to be kosher. Those who are busy designing ASICs just knock up something in Wordpress. Scammers are much more likely to have time for finely crafted HTML 5.

AsicMiner Block Erupter Cube

AsicMiner is not the only company to both sell and use the hardware it has designed and built, but it still makes for an uncomfortable relationship with customers given the rapidly increasing difficulty of mining Bitcoins. A couple of days soak test before shipping can radically affect the profitability of the equipment. The company crowdfunded itself not using Indegogo or Kickstarter but through Bitcoin fora.

AsicMiner’s own mining operation, Allied Control, uses immersion cooling: it dips the boards into a very advanced 3M Novec liquid which boils at a low temperature to use the state change to absorb the heat very efficiently. This points the way for data centres, particularly those mining Bitcoins.

The initial product was a card containing 32 hashing chips and which plugged into an HP backplane. This has been superseded by the Cube, which uses the same 130nm ASICs but on four, smaller cards. Despite it’s finished appearance, the Cube needs quite a bit of work to get it going. It does not have a PSU built in: it’ll need one of at least 200W per card, more if you plan to overclock. Think around a kilowatt.

At the standard speed it’ll produce 30GH/s. Ramp up the power and you might get 38. To get it running you need to log into an incredibly crude on-board web server and configure it. This is non-trivial and involves writing a script to start the mining. It’s a shame that something which looks so plug-and-play needs so much tending. A web page which asked you which mining pool you wanted to join, what your wallet was and what speed you wanted to run at, would make it so much more attractive. However, AsicMiner seems to sell all the kit it makes and is one of the few companies with a solid history of shipping products, so perhaps it has no need to finesse the Cube.

Avalon Clones

Avalon was one of the first companies to make a Bitcoin mining ASIC, despite not announcing the chip until after its rivals had announced theirs. It was for a time the dominant chip vendor.

It sold the ASIC with Batch 1 and then Batch 2 hardware; there were rumours of Batch 3 hardware. People who had ordered one but didn’t receive hardware eventually got refunds, in Bitcoins – so at least they didn’t lose out on the appreciating value of the Bitcoins they had used to order the equipment. It’s widely believed that Avalon used the equipment to mine Bitcoins for themselves rather than shipping kit to punters.

Avalon Clones sells ready-to-go systems based on Avalon’s Batch 1 machine. They come with a PSU, a one-year warranty on the board and a web interface, but the year-old 110nm processors are so far behind the curve today that a $20,000 machine is out-performed by newer $2,000 ones. “Delivery may take two months or more after order,” the company warns.

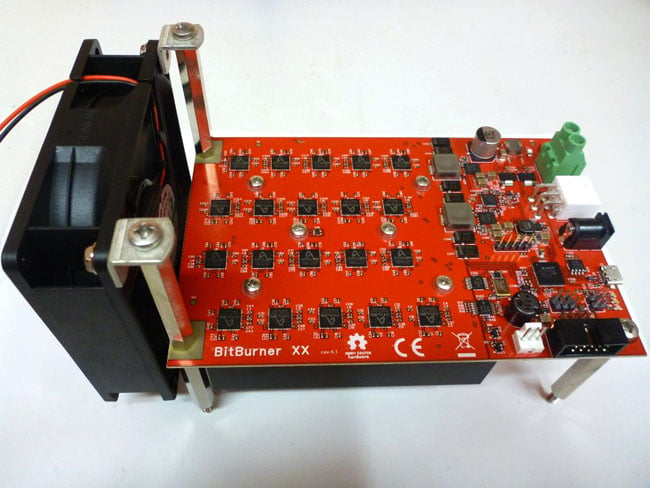

Bitburner Fury

This is a dedicated processing card fitted with 16 Bitfury ASICs and manufactured by the Belgian company CryptX. The design, by the German company Burnin’ Electronics, is reported to be the best using the 55nm Bitfury chips. It’s the rig I know best as I’ve been running a two-card set-up since early December. The kit includes the cards and spacer legs to form a tower. A supplied fan attaches to the edge of a heatsink which covers all the ASICs. You have to add power and control.

I used a 500W PC power supply and fooled it into thinking it was connected with a paperclip. For control I used a Raspberry Pi and the cgminer software. This talks to the mining pool over an Ethernet connection and to the Bitburner via USB.

One of my boards had a bunged up USB port which made re-flashing it very difficult, and forums are full of comments of similar problems. This hardware was assembled in a hurry.

All control is by command line, so being comfortable with a Linux prompt is a bonus in the Bitcoin learning curve.

In use, cooling is everything. I found that the single fan over two cards was not enough to keep the temperature below the 60°C at which it stops working unless I sat it on a window shelf and opened the window a crack. With a second fan and the window still open I could crank up the overclocking to get around 100GH/s combined from the two cards.

Not allowing for the heat loss to the room the electricity cost works out at around 2p/hour. The cards cost around £1500, although they were bought in Euros. It then gets a bit man-maths. Over the month of December as the network difficult grew, the rig dropped from producing one bit coin every ten days to one every 25 days. Given a Bitcoin value of, say, £500 which is as good a number as any, it should pay for itself in six to eight weeks. It will have to run slower in the summer.

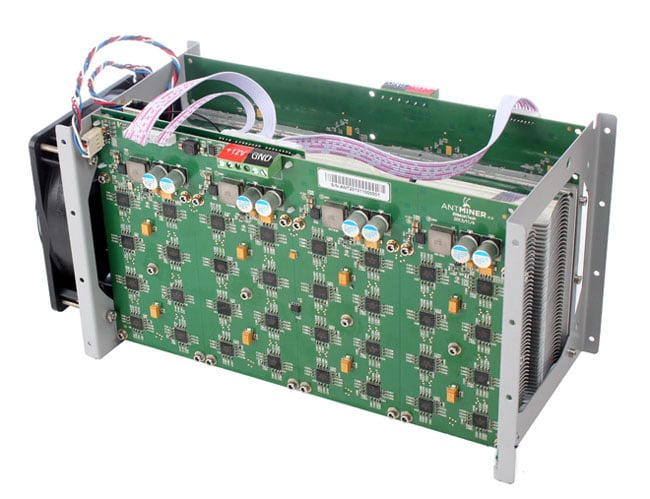

Bitmain AntMiner S1

Bejing-based Bitmain Tech does all it can to look suspicious: it’s bad at answering personal mails through the forums and primarily communicates through Twitter. It does have a website now. Products have, however, shipped and they seem kosher. One customer even posted a video.

The AntMiner S1 is the firm’s first product based on its own BM1380 processor, a 12mm² 55nm device with eight cores. The S1 uses 32 of these chips and is rated to consume between 80 and 200W to produce 180GH/s at a clock speed north of 400MHz. It does not need to be plugged into a computer to run as it has its own Ethernet connection but it does need an external PSU.

Nothing in the Bitcoin world is plug and play. Getting the S1 running means changing your router subnet while you configure it. You can set voltage, time-out and clock speed. Finding the balance between the cost of running the thing, overheating and getting nothing, and not getting enough processing, is precarious. Users say the single fan is adequate but only just. A second one might be advisable, particularly since the fan is quite loud.

If you want one, you’ll have to hang around the Bitcointalk forum or keep an eye on Bitmain’s Twitter feed for the announcement of an auction where the latest batch to be produced is sold off in a couple of hours. The last 120 units went for 4.25 Bitcoins.

Bitmine Coincraft Desk

Bitmine is a Swiss company that has proved its competency doing Avalon clones and has now announced its own processor called Coincraft, a 28nm chip designed to for low-power operation so more of them can be used at once.

As is the industry norm, it is late. Bitmine was supposed to get chips back in November and ship hardware in December, but only received chips on the last day of the year. It has shown working hardware using test boards but not shippable product, although final kit is now expected to ship in March. A three-month delay is hugely significant in the Bitcoin world.

It is very much harder designing an ASIC than to design boards based on other people’s chips. Bitmine has announced Coincraft Desk which is a desktop unit, and Coincraft Rig, a 4U rack-mounted unit. The box is an empty shell and you buy cards which are rated at 200GH/s each, and you can put up to ten cards in a box.

A fully loaded 2TH/s box is $12,000. This is controlled by a Raspberry Pi which one expert feels might work for a few cards but might not be fast enough for ten. They estimate that an over-clock to 2.8TH/s will be possible with a 3kW power supply but this seems optimistic on both fronts. A 110-230V power supply is included, but US household circuits are typically not capable of delivering 3kW through a single power supply.

BlackArrow Prospero

BlackArrow is a Chinese company which has moved on from an FPGA based on public domain designs to its own chip which shows a history of competence. The short Chinese supply chain is a huge benefit. It has announced a 20nm chip, Minion, but has not taped out yet so is currently selling systems with the Bitfury chip on board. It has a $1,000 board with 16 chips rated at 36-40GH/s and is working to use this to fund development of its own processor. This is specced at 1.56GHz, over-clockable to 2GHz, with 64 cores and 0.5W per GH/s. But this is all modelled rather than measured.

BlackArrow is taking orders for the chip at $373 and claiming a 20 April delivery – a slip of five weeks from the previously announced delivery date.

The company also offers the Prospero X1, a desktop unit with it’s own processing, power and Ethernet. It claims out-of-the-box functionality with a web interface, and that it is both silent and low power. For a 100GH/s device this is taking big.

A rack-mounted unit, called the Prospero X3, is an enclosure with ten cards, each taking two of BlackArrow’s 100GH/s chips. So 2TH/s for a very reasonable $5949. If you have some spare rack space this might be the one to go for.

ButterFly Labs Miner

Until recently, ButterFly was the company that had shipped the most hardware and made the most money, though now it has been overtaken by KnC. Still, its success has made it a lot of enemies, largely because it took money promising quick delivery dates and then didn’t ship, or offer refunds.

This is not a scam company despite, and it says a lot about the Bitcoin hardware market that this is one of the more respectable companies around. Plenty of outfits are advertising equipment with impossible dream specifications they can’t possibly expect to ship, but ButterFly Labs has shipped huge quantities of kit. Its reputation, however, stinks.

ButteryFly Labs current product is the desktop 10GH/s Miner and 25GH/s Miner. It also offers the rackmount 230GH/s Miner for $4,255 with 65nm chippery on board. It has announced a 28nm chip called Monarch, which is due imminently. It plugs into a PC graphics card slot to produce 300GH/s and 600GH/s at $1,497 and $2,196, but the reliance on the PC to provide power and cooling introduces significant uncertainty, relying on the user to understand some of the biggest problems of mining: power and cooling. The power is PCIe and does not use the bus rails.

Still if you want something you can sneak into the PC under your desk at work and steal electricity from your employer it has a stealth advantage. The past reliability of delivery on time has been more akin to Sinclair Research’s “allow 28 days for delivery” than people have come to expect in the age of Amazon and eBay next-day delivery.

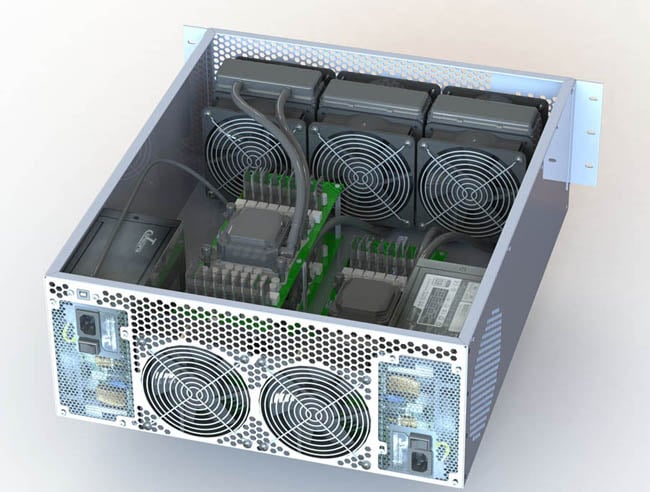

CoinTerra TerraMiner

Of all the Bitcoin companies, CoinTerra is the one with the most chip design experience. The CEO was the lead CPU Architect at Samsung, working particularly on mobile. A mobile processor needs to balance three things: power consumption, heat generation and size. For Bitcoin mining only the first two matter, but mobile experience is invaluable and most of the CoinTerra team have worked in mobile.

The company taped out on 9 November and got wafers back on 28 December - an incredibly fast turn around guaranteed by paying expedite fees to Global Foundries in Dresden Germany - and then shipped to Taiwan for packaging. Its reputation is good on the basis of keeping customers up to date, although is has not shipped anything.

Engineering updates come thick and fast. It seems to be on target to ship this month. The ASIC is called Goldstrike I and has 120 hashing units on each die to give an anticipated minimum of 500GH/s on each chip based on yield. Bitcoin processors often ship with some hashing units failing in the manufacturing process. The chip has four dies.

The chip will go into the TerraMiner range of products, most of which have been discontinued: only the TerraMiner IV is currently on sale. It has four chips to give 2TH/s. The 4U box has two power supplies of 1.1kW each mounted out of the cooling stream with five fans front and back blowing air through custom liquid-cooled heat exchangers and liquid cooling the top of the chip. CoinTerra seems to have given the most thought to the thermal problems of Bitcoin mining and for ‘professional’ use, but the majority are not sold to data centers.

The 2TH/s box costs $6,000. Processing is done by a BeagleBone Black, a Raspberry Pi-alike open source board running at 1GHz.

This seems to be the best thought-through of the devices here, particularly if you have some rack space looking for something to fill it. But it hasn’t shipped yet, but is nonetheless taking orders for May delivery. Unusually for a clean company, CoinTerra has a decent looking website, but don’t let that put you off.

Hashfast Sierra

Hashfast is a very aggressive company in possession of advanced technology and a legal team. It designed and taped out its chip very quickly. Its warranties are short too: customers only got a ten-day grace period. Many rivals offer 90 days to lifetime coverage. Hashfast promised and charged for an 20 October delivery, and while it contracted to deliver by 31 December, it is yet unclear how many machines went out on that date. It may have just made the deadline, but has also offered to issue refunds.

Customers who paid in Bitcoin were promised on the Bitcointalk forum that if Hashfast had to issue refunds, it would do so in Bitcoin. However, as the contract said refunds would be in dollars, it is now only offering that currency. Since $2,000 worth of Bitcoins in October would be worth $10,000 now, this has unsurprisingly ignited the ire of those who pre-ordered.

The equipment is based on the company’s own 28nm “Golden Nonce” - yes, really - processor. The specs are as impressive as the name is dumb: a claimed 400GH/s per ASIC running at 550MHz, with headroom to overclock to 500GH/s. One press release claimed 667GH/s over the four cores. Hashfast also claims the lowest power consumption in the industry: 0.67W per GH/s.

There is a sensible looking range of products, with the tower cased 400 GH/s Babyjet at $2250 and the rack mounted Sierra at $6,300. The latter is rated at 1.2TH/s.

KnCMiner Neptune

Swede Andreas Kennemar and Brit Sam Cole had a business in Sweden building chips for algorithmic trading on stockmarkets but merged with ORSoC to form KnCminer which specialises in Bitcoin processors and miners.

This Register list of products may be in alphabetical order and not worst to best, but KnCminer is the last on the list and significantly the best. It clearly doesn’t understand how to run a Bitcoin miner business because it tells the truth. All the time. It is good at customer relations and amazingly it under-promises and over-delivers. It even has a website which works well.

The result of KnCMiner’s technical skills, time to market and honesty is that it is the most successful of the Bitcoin mining hardware companies.

The hardware is based on a processor designed by the Brobdingnagian Marcus Erlandsson, co-founder and boss of the ORSoC half of the company. The initial, Jupiter device has sold out and KnCMiner is now taking orders for the Neptune. This is claimed to be the first 20nm device which brings the total hashing speed for the $10,000 box to 3TH/s.

Shipment dates are hazy - all it’s saying for now is Q2 - but unusually you can have some confidence in that. More coins are currently being mined using KnCminer than with any other hardware.

Conclusion

Bitcoin mining is hard. Ignoring the software side, protecting wallets and the like, some of the people advertising kit are charlatans. Companies that operate as you’d expect a business to do stand out as saints in this market. CoinTerra and KnCminer are two such paragons.

Generally the idea of plug and play is laughable. Some experience of overclocking PCs, Linux, using a Raspberry Pi and network admin goes a long way and customer support comes from forums and communities rather than from the person you bought the kit from.

Or you could just invest in Bitcoins. If the current rate of growth continues over the next ten years one Bitcoin will have gone from being worth nothing five years ago to worth more than all the money in the world today. It makes the Triganic pu seem wieldy. ®