Original URL: https://www.theregister.com/2013/07/05/seagate_should_buy_fusionio/

Buy a flash kit maker now, Seagate... good ones will be gone soon

We've narrowed it down to the two best candidates

Posted in Storage, 5th July 2013 10:04 GMT

Blocks and Files With Western Digital buying sTec and SanDisk buying SMART Storage Systems, Seagate is looking like the last player standing in the game of flash musical chairs.

These days, a lot of serious storage suppliers are keen to get into enterprise flash storage devices - meaning component devices and not complete arrays such as those supplied by Nimbus Data, Pure Storage, Violin Memory and Whiptail. There are basically three NAND storage device form factors: SSDs using Fibre Channel; SAS and SATA interfaces; and PCIe interface cards.

In very broad strokes, the current state of the main enterprise SSD and PCIe players and wannabe players is this:

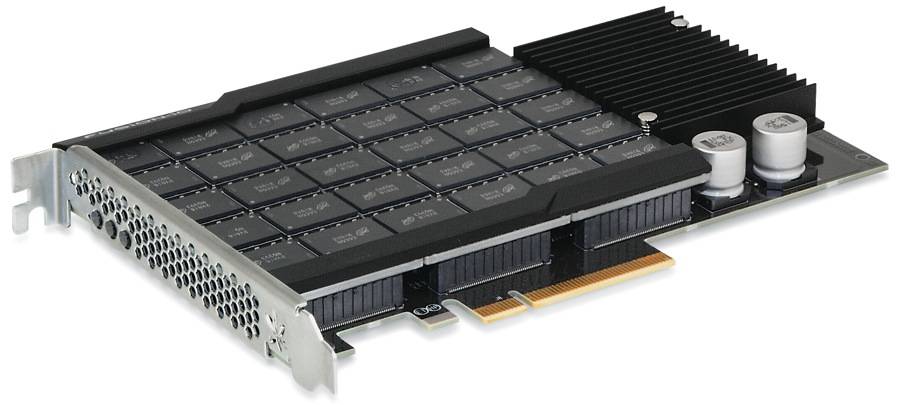

- Fusion-io - with PCIe flash cards and software to speed up apps through caching and/or sharing access to arrays using the cards. It leads the PCIe flash market, counting Facebook and Apple among its major customers, but its share price has steadily declined from a high point of $32.30 in October 2011 to $13.70 today as profitability has not been pursued, there is an over-reliance on too few large customers. Competition has strengthened. It has no flash foundry tie-up.

-

Fusion-io ioSCale card

- HGST - this WD subsidiary sells a line of enterprise SSDs co-developed with Intel. HGST will be the home for sTec in WD's organisation.

- Intel makes SSDs and PCIe flash and is a strong player in the market. It partners Micron in Intel Micron Flash Technologies (IMFT) which operates flash manufacturing foundries. In effect we can say that, in this joint venture, Micron makes the NAND chips and both Intel and Micron take the output and turn it into SSDs and PCIe flash cards.

- LSI is making a big push with PCIe flash cards and has notched up some good OEM wins, including buying the highly successful SandForce flash controller business. It has no flash foundry tie-up.

- Micron supplies SSDs and PCIe flash card products from the foundries it operates through IMFT. It is the number two flash manufacturer by volume and has beaten LSI to be EMC's main supplier of PCIe flash for its VFcache product.

- OCZ was a volume shipper of consumer flash which bought Indilinks for its controller technology and has started moving to become an enterprise flash product supplier. However, it ran into tremendous financial reporting problems during which it changed its CEO and had to arrange emergency banking facilities under onerous terms. The financial reporting problems should be cleared up in August, with a restatement of its results for the past two or three years. OCZ is in a weak position and an acquisition may be the best way forward.

- Samsung - the leading flash foundry operator and supplier of SSDs to OEMs shipping SSD-using products to enterprises and consumers. It has invested in Seagate and also in Fusion-io.

- SanDisk partners Toshiba in operating flash foundries. SanDisk is hugely successful in the consumer flash market and making a determined entry into the enterprise flash market having bought four companies. It ships NAND flash to WD for use in its hybrid disk drives.

- Seagate sells its Pulsar and 600/1200 ranges of SSDs, using controller technology co-developed with Samsung, but these have yet, it is thought, to become popular. Seagate has a tie up with Samsung, understood by us to be for flash reasons, with Samsung having invested in Seagate and been given a board seat. Seagate also has a PCIe market presence through reselling Virident's flash card as theX8 Accelerator. It invested $40m into Virident in January this year.

- Toshiba makes NAND chips in its joint venture with SanDisk and sells SSDs - but is not present in the PCIe flash market. It does have an alliance with Violin Memory which supplies a PCIe flash card as well as flash memory arrays.

- Violin Memory with its Velocity brand PCIe flash cards, priced and positioned aggressively against Fusion-io. These products were announced in March but we have not yet had any insight into their market performance. As noted above, there is an alliance between Violin and Toshiba which should assure Violin surety of chip supply.

- Virident makes PCIe flash cards and flash card-sharing software, and has an architecture that's reckoned to be similar to that of Fusion-io. Virident supplies flash cards for use by EMC in its XtremeSF product and Seagate has invested $40 million in Virident.

We haven't included IBM in this list because, despite buying TMS and selling the RamSan (rebranded as FlashSystem) arrays, it appears to have abandoned TMS's PCIe flash products.

What is Seagate missing?

Seagate, seen from the viewpoint of The Register's storage desk, is missing a few things needed for it to be a strong enterprise flash component supplier: a flash product-skilled channel; a successful line of SSDs, and/or a successful line of PCIe flash cards; in-house PCIe flash product engineering skills; a successful flash software product set; and a working set of OEM flash component OEM and reseller relationships, on par with its HDD OEM and reseller relationships.

It is also in danger of being eclipsed by Western Digital, which could be able to start combining its separate HGST and WD-branded operations next year if all goes well with a Chinese regulator monitoring the two entities.

What should Seagate do?

El Reg sees two options: one good, and the other better but more expensive. These are to buy Virident or to buy Fusion-io.

Virident has less of a market presence than Fusion-io and has absorbed total venture funding of around $120m. A 5x exit for its venture capital backers would mean a price of about $600m, less Seagate's existing $40m making $560m.

Fusion is the market leader in PCIe flash and flash software and is capitalised at $1.35bn. Let's say, dabbing away with our broad brush again, that $1.5bn would secure it. Seagate is capitalised at $16bn and so, in principle, financing the deal is well within its grasp. Fusion-io revenues in 2012 were $359m and it's on track for revenues of $435m in 2013. Virident's annual revenues are, we estimate, in the $30m to $60m area.

There is more scope for Virident to grow. But, were someone else like HP, LSI or even WD to buy Fusion-io, Virident could get crushed by major league competition. Seagate, with its channel depth and breadth and its overall resources, could surely aim to take Fusion-io past the billion dollar run rate in a relatively short time - in our opinion, probably less than five years.

And there is also the happy coincidence that Samsung, an investor in Seagate, is an investor in Fusion-io as well.

El Reg is sure the market would applaud a Virident buy by Seagate. It would be shocked by a Fusion-io acquisition - at first. Then it would be deeply impressed, thinking that the fit between the two is excellent and there really is Seagate skin in the enterprise flash device game.

So go on then, Seagate. Buy Virident if you want to be careful and stay within limited horizons, but Fusion-io is the bolder buy - and might lead to even stronger gains. ®