Original URL: https://www.theregister.com/2013/03/15/vmware_server_virtualization_sddc/

Can VMware boost profits by expanding from data centers to clouds?

Gelsinger & Co. think so – and thus Virtzilla is born

Posted in SaaS, 15th March 2013 19:43 GMT

Analysis Big cloudy startups build their infrastructure on custom – or, at the very least, cheap – iron, and they use open source software because they like to – and often need to – tweak the systems software to make their workloads hum. And that's a problem for VMware.

And it's a big problem, one that makes the company irrelevant except to enterprise customers who have by and large chosen its server virtualization technologies for their data centers and who have not yet decided what to do about all this cloud noise.

If companies decide to be more like Google, Facebook, and Amazon – which is by no means a foregone conclusion – they will do a radical change in the way applications are developed and deployed.

And incidentally, in that world the new Pivotal spinoff from VMware and EMC, which was detailed by the two companies on Wednesday at a meeting with Wall Street analysts in New York, will perhaps be a lot more relevant than VMware, so VMware had better hope and pray and sacrifice whatever chickens it can find that companies do not want to be like hyperscale web operators, and that they just want to virtualize their servers, storage, and networks and automate the operation of them, largely on plain-old x86 rack servers.

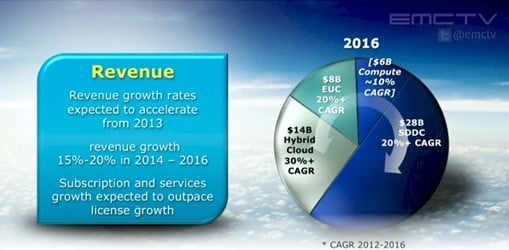

Because in that world, VMware still has a place, and one that it can expand from a fairly modest addressable market of maybe $6bn to what VMware CEO Pat Gelsinger explained to Wall Street would be a $50bn market by 2016 according to VMware's prognosticators.

As Gelsinger explained, the server virtualization racket is doing just fine, with a total addressable market (TAM) of $6bn and a compound annual growth rate of 10 per cent per year over 2012 through 2016, by VMware and EMC estimates. This is a pretty good business, and one that is growing considerably better than the actual physical server biz, which most industry analysts expect to go flat over the same period in terms of revenue and see modest shipment increases if all goes well.

All may not go well as virtualization software improves and vendors cram more and more cores into a CPU socket. The desire for more computing capacity among the elite hyperscale cloud operators who might account for 25 per cent of server shipments has to grow a lot faster than the relatively more modest needs of enterprise data centers for the overall server racket to grow.

VMware's total addressable market will expand to $50bn by 2016, says CEO Pat Gelsinger

At some point, virtualization (which lets a server run multiple workloads interleaved on the same system) and cloud computing (which interleaves computing across multiple divisions or groups within a company on private clouds and across companies in public clouds) work against the Moore's Law advancements. Server makers want to sell more boxes at given price points, which is where there margins lie, but chip makers want to sell just enough more computing per per chip to catch the interest of buyers, but not so much that it grossly impacts volumes and therefore unit costs.

There is a lot of tension in here among users, server makers, and Intel and AMD and their non-x86 competitors.

Small wonder that Gelsigner said this week in an interview with The Wall Street Journal that he doesn't want to be the next CEO at Intel. It's going to be a lot tougher to run a chip business than to run VMware.

Unless, of course, you believe that VMware's attempts to virtualize networking and storage turn out to be incredibly more difficult than the virtualization juggernaut believes. The server-virtualization wave was done with server makers, despite the fact that it went against some of their own interests (selling more boxes regardless of the ridiculously low efficiency of compute on the boxes). It's hard to imagine that network vendors are just going to roll over and let VMware own software-defined networking – but thus far, Cisco Systems, Juniper Networks, HP, and IBM show no such interest.

VMware, with its Horizon tools, has put a big stake in the ground to virtualize and stream end-user computing in many different ways from the data center, and Gelsinger believes that the TAM for end-user computing will be $8bn and grow at a 20 per cent or higher growth rate compounded between 2012 and 2016.

The software-defined data center – or SDDC as VMware likes to call it – consists of all of the vCloud orchestration tools that ride on top of the ESXi hypervisor and plug into the vCenter Server management console to turn it into a cloud plus the underlying compute virtualization. This aggregate SDDC market is growing at around 20 per cent per year or higher, by estimates cooked up by VMware, and will have a market size of about $28bn by 2016. That implies that the management and orchestration extensions in the vCloud stack that VMware has developed and will develop over the next few years will have a growth rate on the order of around 25 per cent.

VMware fluffs up a public cloud

The last slice of the VMware TAM pie is the public cloud that VMware just announced this week, called the vCloud Hybrid Service. This public cloud will ship around the middle of this year and has been developed under the code name of "Project Zephyr."

The addressable market that VMware is trying to chase with its ESXi installations

The basic idea here – and it is a valid one – is that companies that have invested billions of dollars in ESXi and related tools want a compatible set of public clouds (plural) to which they can burst some of their workloads out onto at least some of the time.

The problem is that public clouds, for the most part, as based on open source or homegrown code, and the ESXi and vCloud stack is most certainly neither open source nor free. And therefore, even though VMware can boast that its 220 service-provider partners have collectively built a public cloud that is second in size to Amazon Web Services in terms of the number of virtual servers installed, it is clearly not happy with their collective effort. (It's hard to verify that claim, made by VMware president and COO Carl Eschenbach.)

VMware's executive vice president of cloud infrastructure and management Raghu Raghuram said the issue was quite simple. VMware's 480,000 customers, who have over 36 million VMs running in their data centers, want a public cloud, and VMware was going to give it to them.

The presumption is that VMware is actually not happy with the progress that members of its SP channel have made to take on AWS, and therefore thinks it needs to do it itself. And Gelsinger's promise that service providers will be given access to any intellectual property developed for the VMware public cloud never said it would be for free.

So if you want to now compete with VMware, the odds are that you are going to have to pay more.

The problem that VMware faces is that it has to charge lots of dough for its software and support subscriptions and extract enough profits from them to make Wall Street happy. It's hard to say what price for the vCloud stack would be low enough to make service providers happy – zero dollars sounds about right – and the more El Reg thinks about it, the more we see vCloud Hybrid Service as an admission by VMware that it can't cut software prices to compete indirectly with Amazon through services providers, and instead wants to try to compete against Amazon (and therefore against its own service provider customers) and keep as much of the money as it can.

And hence, as Eschenbach explained in a presentation following the vague launch of the VMware public cloud, the 55,000-strong VMware partner channel that resells ESXi, vCloud, and other tools will be enabled to sell capacity on the vCloud Hybrid Service to chase the $14bn opportunity VMware sees for supporting ESXi shops who want a slice of public cloud to go along with their own virty data center.

So not only is VMware selling against its service provider customers, it is enlisting an army to help it do so. VMware's top brass were too clever to put it that way, and they also cleverly didn't give enough details or allow questions by the press in the first wave of the VMware public cloud announcement earlier this week for it to be clear that this is indeed the case. But after the other presentations were made, it has become abundantly clear this is the deal.

If that doesn't drive service providers into the loving arms of OpenStack, perhaps using a freebie version of ESXi and vCenter consoles, it is hard to imagine what will.

Everyone is in a tough bind on this one, with Amazon eating up all the oxygen in the room, and Gelsinger has now earned VMware a new name: Virtzilla.

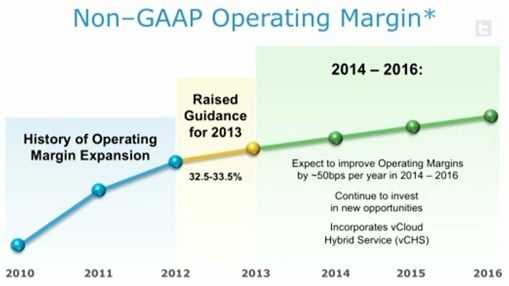

Now here is the funny bit that is not going to make Wall Street happy. Even with all of this total addressable market for public cloud capacity, SDDC, and end user computing growing at somewhere on the order of 20-ish-plus per cent over the next couple of years, and even with expanding into new and adjacent markets, VMware's new CFO Jonathan Chadwick told Wall Street that revenue for VMware would accelerate in the coming years and that revenue growth in the 2014 through 2016 time frame would be on the order of 15 per cent in 2014 and accelerating up to 20 per cent by 2016.

That's lower than the overall growth in the VMware TAM, you will no doubt notice. Subscription and services revenues are expected to be about double the growth rate of software license sales, which probably made more than a few eyebrows go up. So did this chart:

VMware is expecting margin expansion that is slower than potential revenue growth

With all that TAM and revenue growth, non-GAAP operating margin growth seems to be pretty modest – around a half-point a year. So VMware could be an $8bn company by 2016 with non-GAAP operating margins at around 35 per cent. What that says is VMware is going to be getting in a lot of scrappy fights for revenue share and spending plenty of dough on building that vCloud Hybrid Service.

Virtualizing, pooling, and orchestrating servers, storage, and networking

The software-defined data center is all about doing to storage and networking that VMware has done for compute and memory capacity on servers.

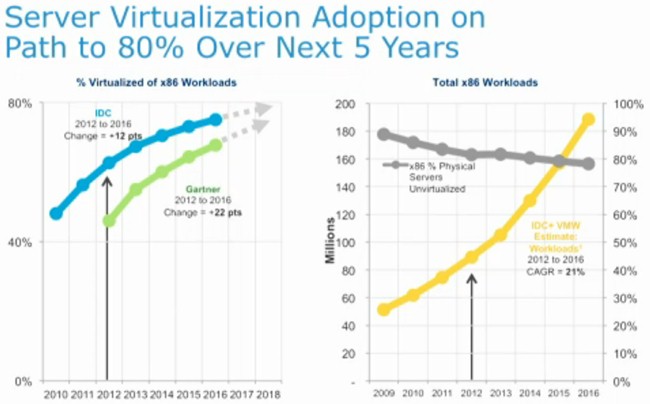

There's still some work to be done on the server virtualization front, of course, but Raghuram said in his presentation that both IDC and Gartner project that around 80 per cent of the workloads that could be virtualized on x86 servers will be virtualized by the end of this decade.

How VMware sees the virtual server racket shaping up

And the number of virtualized workloads (shown in yellow in the chart on the right) will exceed the number of physical servers that are unvirtualized around 2015 or so.

This is a very poorly designed chart, by the way, as well as being fuzzy. It says "x86% of physical servers unvirtualized" in the legend for the gray line in the right chart, but it counts x86 workloads on the axis to the left. If 80 per cent of workloads will be virtualized, how can 160 million x86 workloads be unvirtualized? But we digress...

When VMware looks ahead and counts by workloads – meaning distinct libraries of applications at all companies added up – the business is going to be driven by the virtualization (at all levels) and automation of traditional workloads such as ERP systems, which will grow from 83 million workloads that have been virtualized in 2012 to 141 million by 2017. That's an expansion of 70 per cent over the five years but not a compound annual growth rate.

In addition, one the next-generation of cloudy applications – in which frameworks and Hadoop and distributed computing with algorithmic control of that computing is done by the system, which is all likelihood may not have server virtualization even if it has network or storage virtualization –will see a factor of 7X increase from a mere 6 million workloads running in the world today to 48 million. (In this scenario, presumably Google's search engine is one workload.)

The SDDC opportunity that VMware sees ahead in its future

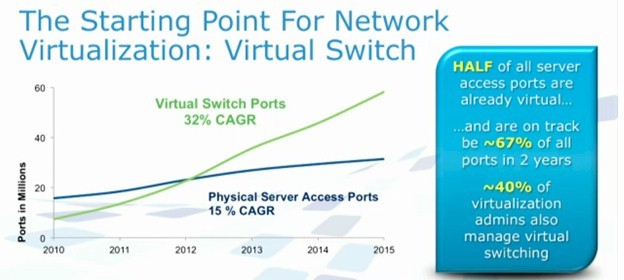

VMware is a bit vague about how it thinks its network virtualization technologies will drive revenues, and it is a bit sensitive about this after having spent $1.26bn on network-virtualizing startup Nicira last summer.

As El Reg previously reported, VMware will start monetizing Nicira's OpenFlow controller and Open vSwitch virtual switch for hypervisors in the second half of this year with a new product called VMware NSX that will mash up the best bits of VMware's hypervisor and the Nicira stack.

VMware has a long, long way to go with network virtualization, but the fact that servers now have more virtual ports than physical ones leads the company to believe that network virtualization, just like server virtualization, is an unstoppable force.

Virtual switch ports already outnumber physical ones among VMware's customers

There is no question that network management is currently too labor-intensive and too subject to errors, and that companies want to add all kinds of services to their networks without having being dependent on their switch and router vendors to provide them. There is also no question that sophisticated clouds have workloads that can change so quickly that the configuration of the servers, the network, and the storage is going to have to be automated to a high degree. VMware would love to automate the living hell out of all of this because that's how it wants to justify its existence and gain its profits.

A counter argument would point out that maybe it would be simpler to not let apps flit around all the time in their VM containers, and instead pay for some excess hardware and data center capacity and avoid some of the Virtzilla controller software tax. The real trick will be running those numbers to see how your enterprise can come out ahead by virtualizing just enough and not cloudifying too much. ®