Original URL: https://www.theregister.com/2011/11/04/is_there_a_patent_price_bubble/

Are we in the middle of a patent bubble?

Fallout from the IP wars could mutate your smartphone

Posted in On-Prem, 4th November 2011 12:58 GMT

Analysis For some time, the only reason the word 'patent' meant anything to the average Joe was if they happened to know that Albert Einstein was a patent clerk before he became a rock star physicist.

Nowadays, everyone is well up on the Great Patent Wars of technology firms, in particular the face-off between Apple and Android OS partners like Samsung and HTC in the smartphone sector.

A little-known asset of firms is suddenly being seen as just that - an asset - something that can be traded and sold, and something that has whatever value the market will ascribe to it. And that could be a dangerous thing for tech companies and users alike.

Analysts are beginning to get concerned about a patent price bubble forming, where the amount of money a company, or indeed an individual investor, will pay for an intellectual property (IP) portfolio rockets out of all proportion to what it's worth.

Just like a price bubble in any other asset, the current market for patents has all the ingredients necessary to push prices up in an uncontrolled manner - high demand, the growth of a secondary market consisting of traders rather than users of patents, and scarcity of good quality IP. The economics here are simple, there's not much of the stuff, but lots of people want some, so the price goes up.

Patent application for a military man-cannon

intended to shoot troops onto rooftops.

This one might not be worth a whole lot.

Add into that the potential revenues from patents - whether you just get other companies to pay you for using them or you use them yourself to enter a lucrative technology sector - and you've got a volatile mix that could cripple innovation, drive up tech prices for end-users and leave some investors out of pocket.

But not everyone's sure the bubble really is on its way. Adam Sutton, director of valuation practices at Price Waterhouse Cooper says prices do seem high, but the value of a patent is tough to measure.

"I think it's very difficult to say a bubble's formed, you can say people are paying high prices but it's very challenging to actually measure what is the strategic and defensive value of a patent," he told The Register.

However, the traders on the ground are starting to worry. Peter Holden, head of IP investment group Coller Capital said in a recent webinar on the prospect of a patent price bubble; "From our perspective, we definitely do see a bubble, specifically in the wireless sector."

"We're [also] finding in certain technology sectors - med tech, commerce, LED, batteries and social networking - there's a perennial need and high demand for patents," he added.

The wireless sector is certainly the most high profile arena for patent sales at the moment, something kicked off by the sale of Nortel's patent portfolio for $4.5bn at the start of the summer to a consortium that included Apple, Microsoft, Sony and RIM.

As the mobile phone industry has moved into smartphones, many companies have been left behind and like Nortel, they have patents they can sell or licence to get cash flowing back into their businesses.

Holden speculated that RIM and Nokia might also consider sell-offs of patents in future and there have also been recent rumours that RIM as a whole could go on sale.

The IP held by either of these companies would look hugely attractive to any firm, but particularly of course to the big players in smartphones, Apple, Android (as a shorthand for Google and its manufacturing partners) and to a lesser extent Microsoft.

PWC's Sutton thinks the high prices paid for a portfolio like Nortel's, or potentially a RIM or Nokia portfolio, are worth it, because this race is about market share in a hugely lucrative industry.

"People are rationally paying higher prices to make sure that they maintain or enhance or their market share," he says.

"If you think that current smartphone shipments are around 300 million, somewhere on that level, and forecast by 2015 to be closer to a billion, that's massive growth and if you take the average price of a smartphone that's a very big market."

But it's not just those who want to use the patents, or guard against litigation on their products, that are buying up IP. According to Holden, there's a growing secondary market in patents, where they're traded like any other asset.

"The whole ecosystem is growing quite rapidly," he said.

However, Ralph Eckardt, managing partner of 3LP Advisors, said in his part of the patent price bubble webinar that a separation had to be made between the big-bucks acquisitions like Nortel and Google hoovering up Motorola Mobility, and the asset-trading IP sales.

"These deals shouldn't be correlated with trading deals, these are more about strategic positioning," Eckardt, whose company designs and executes transactions involving IP assets, said.

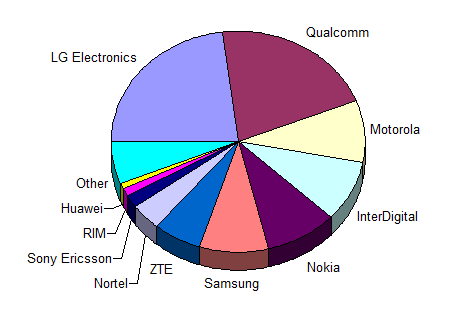

Distribution of LTE (4G mobile tech) patents among the players.

"When we think about strategy, these deals are all about positioning in the marketplace for phones and tablets and about market share, they're not really about exclusion."

In the old days, according to Eckardt, the best route to cost competitiveness in the tech sector was scale - get big quick to reap the cost benefits. But nowadays, IP is the issue that's important to keep costs down.

"For example, if Android is free and it's going to continue to be free, what chance does Microsoft have? How can it possibly compete?" he asked. "But if you force the users of Android to pay, you make Microsoft cost-competitive. IP can be used to dramatically change the cost structure."

And this is the issue that most of the regular punters want to know about, are these patent battles going to drive up the cost of the handsets for the users? Will you be forking out twice as much to lay hands on the iPhone 6 or the Galaxy Nexus 3?

PWC's Sutton says price rises are a possibility, although he feels that competition will keep the jump from being too high.

"I think there'll be a short term impact on prices but it's still going to be a hugely competitive market - where volume of handsets is important, I think there'll still be strong price competition. I wouldn't be too pessimistic about the impact on prices," he says.

The other major issue is that the phones will get crappier because patent wars are stifling innovation, but Sutton doesn't subscribe to this either.

"A lot of people have talked about it being bad for innovation but I think the ability to enforce patents is a core aspect of what drives people to invest the huge sums of money that they do in R&D," he says. "And ultimately that will be of benefit to the end user, even if in the short term there is an increase in prices as some of the litigation is settled in the form of higher licence payments by some of the makers."

If you're looking for any more variation than the big three - Apple, Android and to a lesser extent Microsoft - you might be out of luck though.

The simple fact is, all of the current smartphones are built on top of each other in one way or another (we'll leave it to the courts to unpick exactly how), which means the patents being fought over now are quite likely to decide how the market looks for the foreseeable future.

Even if a bright new company did come up with some wonderful innovation - say 3D holographic projections you can move around and play with in the manner of Tony Stark in the Iron Man movies - they'd still have to build the basic tech with the patents from the existing companies. And unlike standards-based patents, like those in 3G or LTE which are licensed on a fair, reasonable and non-discriminatory (FRAND) basis, these guys don't have to give their toys to anyone they don't want to.

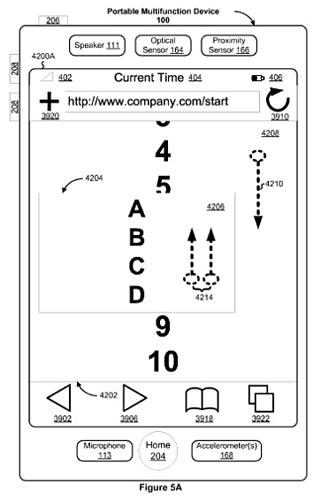

It certainly can be difficult to judge the worth of any given smartphone patent.

This one covers tech intended to bring a dropped phone in to a soft

landing after its accelerometer notes that it is falling fast.

"To enter the smartphone market takes a huge amount of capital anyway so I don't think you're likely to see any significant new players you've never heard of entering that segment," Sutton says.

That situation raises the spectre of anti-competition law coming into play. Assuming one of the big three could win all the cases and drive the other two out, would the EU Commission or the US Trade Commission allow it?

According to Sutton, the prospect is too unlikely to really worry about.

"I'm sure they'd love to drive each other out, but I don't think it's realistic," he says.

"I think [competition is something] that regulators would look closely at, but I can't see any of the three big players, Microsoft, Google or Apple, dropping out of the space anytime soon, so you'll still have hearty competition because those three players have got plenty of cash, they've got significant interest in each of their OSes and the markets they're playing are very attractive and very large."

There is still a way that patent prices could be pushed up artificially, however, and that's the so-called patent trolls. These are companies that are acquiring IP purely to bring litigation against people they see as infringing on that IP.

There's some question of where the line is between specialists who trade IP assets and seek licensing fees and these trolls, but leaving that aside, aggressive trading of any asset, particularly a complex one, generally turns out badly.

Problems in various housing markets worldwide, that whole credit-default-swap (CDS) business that caused the global financial crunch and even the Great Crash of 1929 can all in some measure be traced back to people who don't really know what they're doing entering a market they don't know much about to make a quick buck.

"Some people might be jumping on the bandwagon without a good understanding of what they're buying," says Sutton. "A good amount of diligence needs to go into a examining a portfolio to fully understand what the opportunities are for it and how strong those patents are and obviously that takes a lot of specialist expertise."

IP investor Holden also said his firm "has concerns about the growth of the industry", with "indiscriminate new money" coming into the IP market.

"The biggest issue is quality, we're overwhelmed with opportunistic offerings in the market that we do need to review, which is draining our resources," he said.

This one's probably worth a bit.

Because that's the tough thing about patents, it's quite hard to figure out what they might be worth. Anyone who's ever read a patent description can tell you that it's a virtually impenetrable load of splaff to all but the people intimately involved in the technology of that sector - that's why many of the courts have to get experts in to help them through these cases.

Examining patents takes a lot of expertise and market analysis to figure out if they're actually worth anything or not, anyone but the experts are bound to be hoodwinked.

"There are two ways people tend to value most things, a market approach or an income approach," Sutton explains. "And I think with patents because they're so specific it's very difficult to read across the market for value.

"Like 'This portfolio sold for $4.5 million so per patent that translates to $60,000, therefore that's how much someone might pay for RIM's patents' - I don't think a market approach works in this context."

"You need some sort of discounted cash-flow method. So look at the potential income streams in licence and royalty fees or the licence fees and royalties you avoid paying if you have those patents, more of a look at what the future cash flows are," he adds.

For Holden, "it's a very opaque, ambiguous process, heavily based on negotiation rather than a scientific process."

Sutton also says, in something of an understatement; "It's probably not an area for the less-savvy investors to jump into without specialist advice".

The very complexity of the assets should help to keep many investors away, especially in the current economic climate, but rising returns in what's shaping up to be a pretty stable sector could prove too attractive to some.

So it's next to impossible to tell if IP's onward march is indicative of a price bubble or a growing trend. In fact, it's the sort of thing economists constantly struggle with, even with the ingredients all laid out, a sector could as easily end up with a perfectly formed mousse as a deflated soufflé.

But all the patent players seem pretty sure of one thing - it's a huge issue for technology. And it's probably the issue for the smartphone sector, likely to shape market share, prices and innovation in what's fast becoming a multi-billion dollar industry. ®