Original URL: https://www.theregister.com/2010/12/13/ibm_real_systems_business/

IBM's blue bigness: A heftier systems bulge than you'd expect

We have two sexy models to prove it ...

Posted in Channel, 13th December 2010 09:45 GMT

Analysis How big is IBM's systems business? Based on my own model of revenues for the company, the answer is that IBM's systems sales each quarter – including servers, storage, operating systems, and maintenance – is considerably larger than its quarterly stats for server sales. A lot larger, in fact, and the business is a lot more stable than the quarterly ups and downs of the server hardware business might lead you to believe.

Because IBM likes to keep everyone guessing, the company does not provide revenue figures for its three server lines – four if you count BladeCenter machines separately from System z mainframes, System x x64-based servers, and Power Systems iron. IBM talks about how each server line grows or shrinks each quarter, and if you look carefully at its financial presentations, they reveal what percentage of overall revenues in IBM's Systems and Technology Group each quarter comes from servers and storage, what percentage of Software Group revenues comes from operating systems, and what percentage of overall Global Services revenues comes from maintenance for hardware and software.

If you make some initial assumptions, you can build a revenue model for IBM's server revenues and then for adjunct storage, operating systems, and maintenance revenues to get a reckoning of what its basic systems business is really generating in terms of revenues for the company. I put together my own model five years ago when the top analysts at Salomon Smith Barney and Merrill Lynch stopped putting out their own models of IBM's system component sales for each quarter. I don't make any claims about the accuracy of the model I have built, except that it fits the public data given out by IBM, more or less.

Big Blue has seen stories including these numbers over the years and hasn't called up screaming at me, nor has it offered to give me inside data as it does with Gartner and IDC to help them build their models. So take the data I am presenting here with two dashes of salt and maybe some pepper. If you have built a better model, I am happy to compare notes, too.

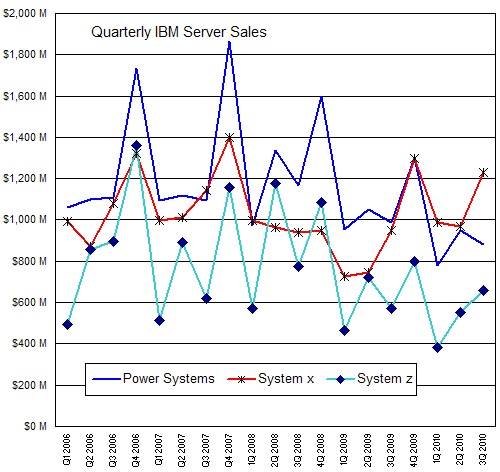

With this model, here's what IBM's server hardware looks like, quarter by quarter, from the beginning of 2006 through the first three quarters of 2010:

IBM's server hardware revenues, 2006 through 2010

As best as I can figure, IBM had $2.77bn in server hardware in the third quarter, with $657m of that coming from System z mainframes, $884m coming from Power Systems iron, and $1.23bn coming from System x and BladeCenter x64-based servers.

As you can see, IBM's quarterly sales for systems is very spikey, and System x boxes were particularly hard hit by the Great Recession in 2008 and early 2009. The spikes for Power Systems revenues keep getting shorter and shorter as the years go by and the Unix market contracts because of the recession and because of more intense competition from fat Windows and Linux boxes.

Mainframe revenues have been trending down because of the recession as well, but have been hampered by the impending announcement of System zEnterprise 196 machines this year. One interesting bit is that in the third quarter of 2009, System x iron almost matched Power Systems sales, matched it in the fourth quarter, and has beaten or matched the Power platform since then. The disparity was jarring in the third quarter of this year, when Power7 transitions really slammed the Power Systems line and Xeon chip transitions were well behind Big Blue and other players. System z sales have been on the rebound all year and will likely be even higher in the fourth quarter, but it seems exceedingly unlikely that they can come close to the peak hit four years ago. But, it is possible. It seems absolutely impossible that Power Systems hardware sales will get anywhere close to the peak set in the fourth quarter three years ago, but it could do as well as at the end of 2008. We'll know in about a month or so.

Playing to its strengths

By my model, IBM will have to sell $966m in System z mainframes and $1.68bn in Power-based servers in the fourth quarter of 2010 to get overall sales for 2010 to match the annual sales levels set in 2009. Forget about setting record sales levels for the past decade.

IBM may have started out as a hardware vendor, but that is not where the money is anymore, even if IBM does need to sell hardware to get to those software and services profits.

IBM's operating systems business is not huge by Microsoft standards, but AIX and IBM i (formerly known as OS/400) help pad the revenues and bolster profits, and the z/OS, z/VM, and z/VSE monthly revenue stream is steady money for which IBM hardly has to do any work. IBM also receives some revenues reselling Windows and Linux on its server platforms. The average is somewhere between $500m and $600m per quarter. So add that to the systems bucket.

Now, add in external storage sales, which includes disk arrays, tapes drives and libraries, and sundry other storage devices. To be sure, IBM sells storage that sometimes is attached to other servers, so not all storage revenues are directly affiliated with a specific IBM server platform. But that doesn't make them not a part of IBM's overall systems business. Generally speaking, IBM's storage revenues, in my model, range from $700m to $1.1bn (I am rounding).

Now, let's add in the maintenance revenue stream from IBM Global Services. IBM doesn't provide a breakdown of maintenance revenues by product line, and for the sake of this simplistic model, I am attributing all hardware and software maintenance revenues to the IBM systems business. Yes, IBM provides tech support for other people's systems, but it is hard to believe that this matters much.

I suppose you could say that a portion of IBM's systems business – and perhaps a very large portion of it – is sitting over at Global Services, where the company manages servers on behalf of tens of thousands of customers for billions of dollars. I have not added this in to get IBM's "real" systems business.

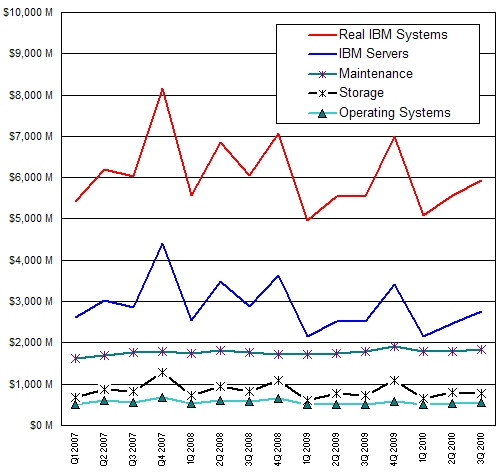

When you add up servers, storage, operating systems and maintenance over the past five years (minus Q4 2010), here's what it looks like in my model:

IBM systems revenue, 2006 through 2010

As you can see, the "real" IBM systems business is wiggling somewhere between $5bn and $7bn per quarter – roughly twice as much revenue as is generated from raw server iron each quarter. Look at how steady those maintenance and operating system revenues are. Everyone loves a business like that, particularly considering that the gross profits on both have to be quite high.

This is why IBM stays in the systems business, and will continue to do so as long as it can generate revenues and make money. ®