This article is more than 1 year old

MoneySupermarket: Google never warned us about payday loan AD BAN

Mountain View rival says it now complies with Brit trading rules

Google temporarily pulled every single one of the pay-per-click ads of a major UK-based online price comparison firm from its search results over the weekend. According to Mountain View, the 24-hour ad-yank - which included the removal of ads comparing home and car insurance products - was a reaction to MoneySupermarket.com's apparent failure to stick to Mountain View's policies about payday loan ads.

A spokeswoman at Moneysupermarket told The Register:

MoneySupermarket's payday listing site is compliant with OFT [Office of Fair Trading] guidelines.

Our payday loans listing page has plain information for customers to make an informed choice, including what such loans cost and illustrative examples. We include a clear warning at the top of the page.

Google suspended MoneySupermarket PPC [pay per click] ads for 24 hours but gave no warning. After several discussions, this service is now back on.

The price-comparison site saw its ads for car and home insurance products yanked by Google on Saturday 6 April. The Drum first reported on Monday that MoneySupermarket had been punished by Google for supposedly flouting UK rules. The ad giant told the The Drum:

We have a set of policies which govern what ads we do and do not allow on Google. We have strict policies for those advertising short term loans, and make it very clear that advertisers need to comply with local regulations and be transparent about their fees, implications of non-payment and collection practices.

If we discover sites that are breaking this policy we will take appropriate action.

The aggressive stance came after the OFT issued a warning in March this year when it said that it planned to come down heavily on the country's leading 50 payday lenders. The watchdog said they had 12 weeks to change their business tactics or risk losing their licences.

The OFT said it would crack down on such outfits after it uncovered evidence of "widespread irresponsible lending". The regulator said last month that it had referred payday lenders to the Competition Commission.

MoneySupermarket confirmed to El Reg that it had "made the few extra changes that were required for Google’s guidelines" so that it could continue to run its ads.

Competition concerns haunt Google

Google ramped up its interest in the UK price comparison market in 2012 when it launched banking, mortgage and car insurance services for customers to compare products by different providers.

The timing of Google's entry into those markets surprised some given that the Larry Page-run company continues to attempt to bargain with the European Union's competition commissioner Joaquin Almunia over how the multinational's search business is conducted in the 27-member bloc states.

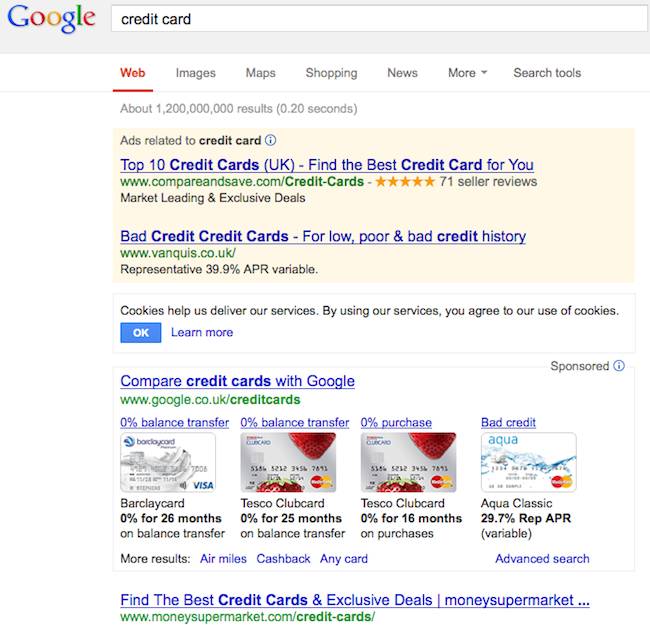

A Google search for 'credit card' puts the ad giant's service ahead of its UK-based rival MoneySupermarket

He has highlighted four areas of concern where the company has allegedly abused its dominance of the search market in Europe and is currently locked in talks with Google to come up with "remedies" that would satisfy Mountain View's competitors and avoid sanctions being imposed by the Brussels' antitrust chief.

Two of those areas relate directly to how Google displays links to its own vertical search services, which compete directly with other price comparison sites. Almunia said in May last year:

In its general search results, Google displays links to its own vertical search services differently than it does for links to competitors. We are concerned that this may result in preferential treatment compared to those of competing services, which may be hurt as a consequence.

El Reg gently pushed MoneySupermarket for its views on that investigation in light of its pay-per-click ads being temporarily killed by Google over the weekend.

But the company, which is not listed as a complainant in the EU competition case, declined to comment.

We also sought a statement from the OFT to see if had any specific concerns about MoneySupermarket. A spokesman declined to comment directly on the price comparison site and said that companies needed to comply with the rules laid out by the OFT. He added: "We generally welcome actions such as that taken by Google that support consumers." ®