This article is more than 1 year old

No, VMware doesn't own server virtualization

It just feels like it

With the VMware-sponsored VMworld extravaganza in the rear view mirror, it's a good time to take stock of the server virtualization that companies around the world are deploying - to remind everyone that there are lot of different ways to skin the server virtualization cat and that plenty of alternative skinning is going on out there in the real world.

Lost in all of the noise at VMworld was a survey commissioned by Centrify, which asked companies of all stripes, sizes, and geographies what they were doing in terms of server virtualization. Like everyone else out there in IT land, Centrify is trying to align its identity, access management, and auditing tools - which were created for physical servers and their operating systems - with the new virtualized environments. And so it commissioned a survey to ask companies what they are up to. As is usually the case, the number of respondents to the survey was pretty skinny, so you have to take the numbers with a grain or two of salt and weigh for yourself if they are representative.

Given the prevalence of x64 servers out there in the real world, you would expect that hypervisors made for x64 servers would dominate and, given VMware's dominate market share, that VMware would dominate. You'd expect even with low penetration of hypervisors relative to proprietary midrange and mainframe platforms (which almost universally have hypervisors installed) and big Unix boxes (which have hypervisors on roughly two-thirds of midrange and enterprise-class machines). And indeed, Centrify's surveys of IT shops bears this out.

Some 91 per cent of the companies polled by Centrify said that they had a hypervisor of some sort on at least one of their server platforms, and 98 percent said they would have at least one platform virtualized by 2010. A pretty healthy 26 percent of those polled said they have virtualized at least half of their servers already, and by the end of 2010, 51 per cent of the companies polled said they expected to have the majority of their servers virtualized.

Only 4 per cent of IT shops that spoke to Centrify said they would have all of their servers virtualized by the end of 2010, and 22 per cent of those polled said they expected to have a fifth or less of their physical server platforms virtualized over that same term.

About 32 percent of the companies polled that have hypervisors installed on at least one platform say they use VMware's ESX Server (bare-metal or type 1), ESXi (type 1 and free), or VMware Server (type 2 hosted and also free) software to virtualize their iron. Another 43 per cent of the companies used a mix of VMware and other server virtualization products, and 25 per cent have virtualization, but none of it is from VMware. About 38 per cent of the IT shops polled by Centrify said they only had one hypervisor platform at their company, 29 per cent said they had two different ones, and 33 per cent said they had three or more hypervisors carving up their iron into virtual bits.

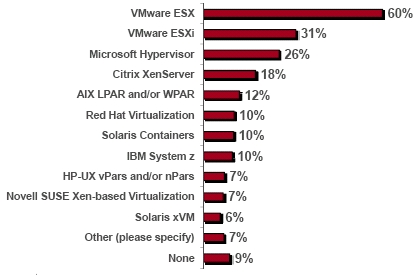

Here's the distribution of hypervisors by company according to the Centrify survey:

VMware's ESX Server is used by 60 per cent of the companies polled, and the freebie ESXi hypervisor is used by 31 per cent of companies. A little more than a quarter use Microsoft's Virtual Server (type 2) or Hyper-V (type 1) hypervisors, and the XenServer hypervisor is used by 18 percent of companies. The other hypervisors that are embedded inside of Linux distros or that are paired with Unix environments are also seen - and in proportions that make sense give the global installed base of iron.

None of these numbers tell you anything about the relative size of the installed bases for server hypervisors or the amount of money these different hypervisors generate for their vendors.

Here's the interesting thing about the companies that Centrify talked to. About 27 per cent of those polled said they use VMware hypervisors on non-critical systems and the remaining 73 per cent say they use them on a mix of critical and non-critical iron. And while 55 per cent of the companies said they will be increasing their use of VMware products, 52 per cent said they were open to using virtualization products for their servers from other vendors, and 5 per cent said straight up they were cutting back on their VMware budgets.

This server virtualization market battle is far from done. ®