This article is more than 1 year old

Doubles all round for the server-makers: Market inhales $23.36bn for the quarter

Dell EMC, HPE and ODMs frolic as cloud rains cash

The continued data centre refresh cycle and seemingly insatiable demand from the big cloud slingers to bulk out their infrastructure saw server vendors make hay while the sun shone in Q3.

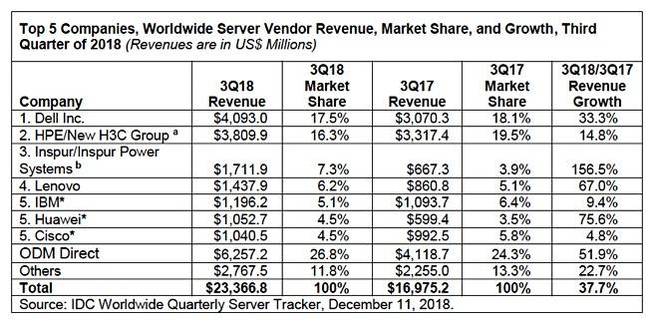

Global market revenues climbed 37.7 per cent to $23.36bn and shipments went up 18.3 per cent to 3.161m, according to stats from IDC.

Dell, which yesterday was given the go-ahead by Class V shareholders to buy up their stock and go public later this month, led the market, growing revenue by 33.3 per cent to $4.09bn and units by 10.5 per cent to 556,000.

This is the third straight quarter since Dell knocked HPE off its perch: HPE revenue was up 14.8 per cent to $3.8bn but its shipments fell 9 per cent to 456,200. HPE has pulled away from the low-end server market.

Chinese ODM Inspur leapt into third spot, overtaking Lenovo. IDC said Inspur turned over $1.711bn revenue, up 156.5 per cent on the back of 283,600 units, which was a shipment rise of 90.2 per cent. Lenovo grew 67 per cent to $1.437bn and sold 193,500 servers, up 27.5 per cent.

Over at IBM, server revenues jumped 9.4 per cent to $1.196bn, but Big Blue didn't register in the top five biggest sellers in terms of the numbers of systems sold.

Huawei and Cisco were seen as virtually tying with IBM with revenues of $1.052bn and $1.04bn, up 75.6 per cent and 4.8 per cent respectively. Huawei flogged 187,900 servers but Cisco's unit numbers meant it was outside of the top five and therefore not mentioned.

The remorseless rise of the ODM Direct section - Chinese contract manufacturers that build servers to order – continued, growing 30.5 per cent to $6.25bn, and accounted for 871,500 units. The others section made up the rest of the sector.

Here's IDC's table of revenue numbers:

And a unit shipment chart:

Geographic numbers show the dominance of Asia, and China in particular, in terms of growth rate, but IDC hasn't released the actual revenue numbers.

Asia/Pacific (excluding Japan) was the fastest growing region with 46.5 per cent year-on-year revenue growth. The US grew 43.7 per cent, while Europe, the Middle East and Africa (EMEA) grew 24.5 per cent.

Canada grew 20.0 per cent, Japan 14.0 per cent, Latin America a miserly 7.7 per cent, but China revenues rocketed 67.1 per cent.

Sebastian Lagana, IDC research manager, said: "Enterprise infrastructure requirements from resource intensive next-generation applications support increasingly rich configurations, ensuring average selling prices remain elevated against the year-ago quarter. At the same time, hyperscalers continue to upgrade and expand their data centre capabilities." ®