This article is more than 1 year old

You can blame taxes for a profit nosedive, but Seagate... the taxman didn't flatten your sales

Cue dramatic music as activist investor joins board

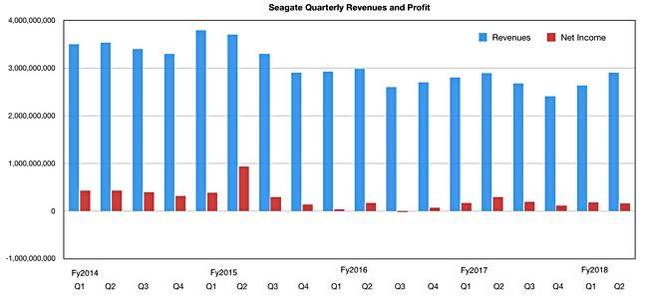

Seagate reported essentially flat revenues and a fall in profits in its disappointing second fiscal 2018 quarter.

Revenues in the three months to December 29, 2017, were $2.9bn compared to $2.89bn a year ago, and $2.63bn in the also-disappointing prior quarter.

GAAP net income was $159m, compared to $297m a year ago, a 47 per cent drop, and 12 per cent lower than the $181m recorded in the first fiscal 2018 quarter.

The company generated $850m in cash flow from operations and $773m in free cash flow. Senior analyst Aaron Rakers of Wells Fargo said the cash flow number was very strong and "solidly ahead of our $500m estimate and the consensus estimate of $411m."

He also said revenue and non-GAAP earnings per share surpassed expectations.

Western Digital had record results in its equivalent quarter, reported last week. How did Seagate polish its dull revenue number?

CEO Dave Mosley said: "Achieving year-over-year revenue and profitability growth and significant cash flow generation in the December quarter reflects Seagate’s solid execution and competitiveness of our storage solutions portfolio."

Profitability growth? A bit. Profit before income taxes was $371m, compared to $310m a year ago.

The new US tax laws, which so affected Western Digital, are again mentioned as a reason for income taxes taking such a bite out of the profit before tax number. Without that, GAAP net income could well have risen, insists the vendor.

Why was there no effective revenue growth? It didn't sell enough disk drives.

Seagate shipped 87.5EB of capacity (WDC shipped 95.3EB) and 40 million drives (WDC - 42.3 million), lagging WDC. According to Rakers, Seagate shipped 35.1EBs of high-cap/nearline drive capacity, up 62 per cent yr/yr. Seagate now generates ~40 per cent of revenue from enterprise HDDs.

Other disk drive market segments were all down:

- Client HDD capacity shipped totalled 19.2EBs, up 12 per cent yr/yr, with client HDD revenue of ~$670m; down 4 per cent yr/yr,

- Non-compute HDD capacity shipped totalled 30.9EBs, up 15 per cent yr/yr, with non-compute HDD revenue at ~$860mn down 3 per cent yr/yr,

- Mission-critical enterprise HDD capacity shipped totalled 2.4EBs, down 8 per cent yr/yr (vs. -13.5 per cent yr/yr in the prior quarter).

Rakers says Seagate’s total enterprise HDD revenue totalled approximately $1.2bn, up 9 per cent yr/yr. That implies the combined revenue fall from the other drive sectors more or less wiped out that 9 per cent rise, leaving revenues flat.

What about the future? Mosley said: "Looking ahead, we will continue to focus on operational excellence and accomplishing our financial and shareholder-return objectives.” Yes Dave, but what about real growth?

Rakers said: "With cost reductions nearly completed, we continue to believe that Seagate’s ability to grow its top-line becomes an increasingly important investor focus."

Activist investor on board

Intriguingly Seagate has appointed two new directors to its board. Judy Bruner is described as having "deep experience and career success in the global high-tech industry as a finance leader."

Dylan Haggart, Seagate said, "has been a respected contributor to our board since 2016 in his advisory role and we look forward to his continued counsel as a board member." Haggart is a partner at ValueAct Capital which is currently one of Seagate’s largest investors, with a shareholding of 7.4 per cent.

ValueAct is described as a very active investor that identifies companies that appear to be out of favour, or may be undergoing a significant transition and aims to improve them.

Compared to Western Digital, Seagate has virtually no presence in the SSD market, and SSDS are cannibalising high-end disk drives. However, it has said it has concluded a strategic flash supply agreement with Toshiba. Observers are waiting to see how Seagate will capitalise on this agreement and get a stronger presence in the overall SSD market. ®