This article is more than 1 year old

IBM will soon become sole gatekeepers to the realm of tape – report

Yeah, cloud service providers, large enterprises still need it

Spectra Logic's Digital Data Storage Outlook 2017 report predicts IBM will emerge as the sole tape drive manufacturer.

The 24-page report is available for download (PDF) with no registration. This is Spectra Logic's second such annual report.

It reviews the rise of flash and its effect on disk, tape and optical storage media against a background of steadily growing data storage requirements, asserting that there could be a total of 20 zettabytes stored in 2026.

The report has a set of high-level conclusions:

- 2.5-inch 15,000rpm disk drives will be completely displaced by enterprise flash

- 3.5-inch disk will continue to store a majority of enterprise and cloud data requiring online or nearline access if, and only if, the magnetic disk industry is able to successfully deploy technologies that allow it to continue the downward trend of cost per capacity

- The flash industry will likely improve its manufacturing costs associated with 3D NAND, thereby allowing it to continue its downward trend of cost per capacity

- Tape has the easiest commercialisation and manufacturing path to higher capacity technologies, but will require continuous investment in drive and media development. The size of the tape market will result in further consolidation, perhaps leaving only one drive and two tape media suppliers

- Optical disc will remain a niche technology, primarily in the media and entertainment sector, unless great strides can be made in the production cost of the new higher capacity discs

- No new storage technologies will have significant impact on the storage digital universe through 2026 with the possible exception of solid-state technologies whose characteristics straddle DRAM and flash

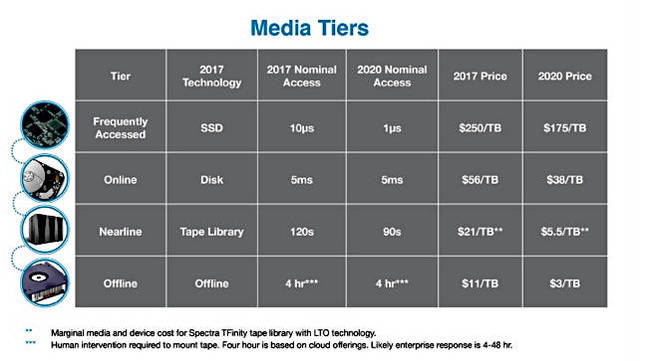

The report outlines Spectra's view of media tiers in 2017 and 2020:

Spectra's view of media tiers

Magnetic disk

The company thinks consumer device disk drive shipments will fall to virtually zero in 2022 for two reasons; flash replaces disk in consumer devices and more consumer data is stored in the public cloud and streamed for consumption.

The report states: "Spectra is predicting a very aggressive decrease in the shipped aggregate capacity of consumer magnetic disk as flash takes over that space. Capacity increases in enterprise storage, whether in the online or nearline tier, will not maintain a pace that will allow the disk industry to realise revenue gains."

Optical disk

Spectra's report says Sony and Panasonic's 300GB "Archival Disc" will find favour with customers that have definitive long-term (essentially forever) archival requirements.

"The size of this particular market segment is small compared with the overall market for archival storage." Spectra "places Archival Disc media, in terms of pricing, between flash and disk, and about 10 times more expensive then tape."

Tape

Concerning tape usage, the report says: "A fundamental shift is underway whereby the market for small tape systems is being displaced by cloud-based storage solutions. At the same time, large cloud providers are adopting tape – either as the medium of choice for backing up their data farms or for providing an archive tier of storage to their customers."

Tape's capacity headroom is immense:

This is singularly due to it having substantially more surface area on which to deposit data than any other medium. Think of almost 3,000 feet of tape spooled out compared to seven 3.5-inch disk platters or one optical DVD.

Linear Tape Open (LTO) is the primary tape technology, with seventh-gen LTO-7 (6TB raw) arriving in 2015. LTO-8 (12TB raw) will likely appear in October 2017. Two or three further generations are on the roadmap.

IBM's proprietary TS1155 format is beating LTO-8 with a 15TB drive using new Tunnelling Magneto-resistance (TMR) read sensor head technology. Spectra thinks this technology could double capacity through four generations, so reaching 240TB raw.

Further: "Cloud providers will mostly adopt LTO, and given their strength in purchasing overall tape technology, this will lead to a greater percentage of LTO versus enterprise tape technology. Enterprise tape, with two suppliers, appears to be an over-served market and Spectra predicts that, at some point, the market will converge to one."

It is Spectra's opinion that IBM will be the sole manufacturer of enterprise-class tape drives and media in the years to come.

Another, and perhaps more optimistic, conclusion is this: "Spectra believes that a probable long-term scenario is one in which flash technology and tape will coexist, and become the prevailing storage technologies for online and archive needs, respectively."

You wish. ®