This article is more than 1 year old

Gartner: It's tough out there for server-sellers

There's HPE, Dell and two rampant Chinese server dragons chasing them

Gartner's number-crunchers say the server market declined in the third quarter, with only Cisco and the Others supplier category showing revenue growth.

Worldwide server revenue slumped 5.8 per cent from a year ago with shipments sliding 2.6 per cent. In the x86 category, there was a 1.6 per cent decline in revenue and 2.3 per cent in shipments, indicating that proprietary server revenues and units fell further than x86 servers.

Gartner server guru Jeffrey Hewitt, actually a research VP, said: "The server market was impacted during the third quarter of 2016 by generally conservative spending plans globally. This was compounded by the ability of end users to leverage additional virtual machines on existing x86 servers (without new hardware) to meet their server application needs."

The Gartner report says that, in x86 server shipments, only Huawei and Inspur Electronics experienced growth. They make a dynamic duo standing out against a dull background.

In revenue terms:

- HPE led with a 25.5 per cent share, though declining 11.8 per cent

- Dell is second with a 17.5 per cent portion and a 7.9 per cent fall

- Third-placed Lenovo has a 7.8 per cent share with a 6.7 per cent fall

- Cisco is close by in fourth position with a 7.3 per cent share and 5 per cent growth

- IBM is number five with a 7 per cent share and 33 per cent fall

- The Others category has a 34.8 per cent share and saw 7.4 per cent growth

Tabulated server revenue numbers for the third 29016 quarter:

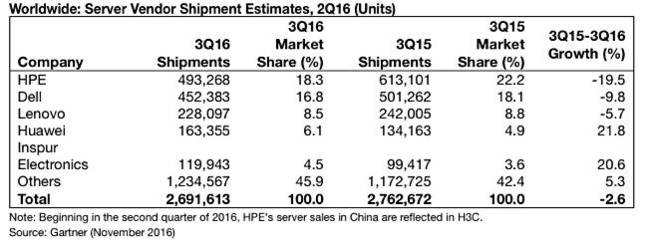

The server shipment numbers show the same overall pattern, with slight differences. Again Huawei and Inspur were the only vendors in the top five to increase server shipments in the quarter.

Tabulated shipment numbers:

All geographies saw tougher conditions, with EMEA showing a third consecutive quarter of decline.

So what can vendors do? Hewitt says they "need to reinvigorate and improve their value propositions to help end users justify server hardware replacements and growth, if they hope to drive the market back into a positive state."

Well, that is easy to say, but much harder to do. Whatever Huawei and Inspur are doing – they need to do it too. ®