This article is more than 1 year old

Looking behind HPE Storage's top-line revenue numbers

StoreServ carries HPE's storage growth hopes on its shoulders

Analysis HPE’s traditional storage declined faster in the first 2016 quarter than the newer converged storage revenues rose. Hence the storage segment in HPE’s Enterprise Group was down three per cent year-on-year to $810mn, from $837m.

It was also down sequentially, quarter-on-quarter, from $810m in the fourth 2015 quarter.

In constant currency terms HPE storage grew 3 per cent year-on-year.

Traditional storage (EVA, tape, MSA, etc) revenues were $358mn, down 15 per cent from a year-ago and 8.3 per cent from the previous quarter.

Converged storage (StoreServ, etc.) revenues were $452mn, up just 8.7 per cent from the year-ago quarter; it’s not rocket-like growth year-on-year. Their revenues were up 4.7 per cent from the preceding quarter, showing a similar situation.

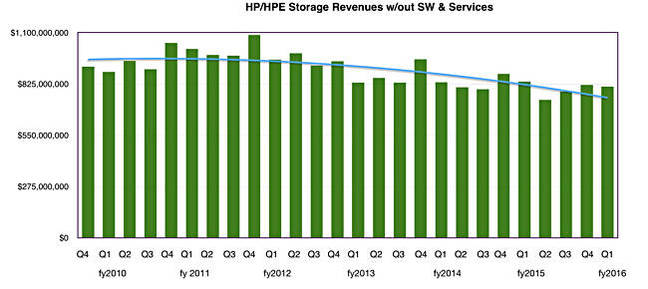

Putting this in a historical context, here is a chart showing HP and now HPE’s quarterly storage revenues:

The trendline shows the downward arc.

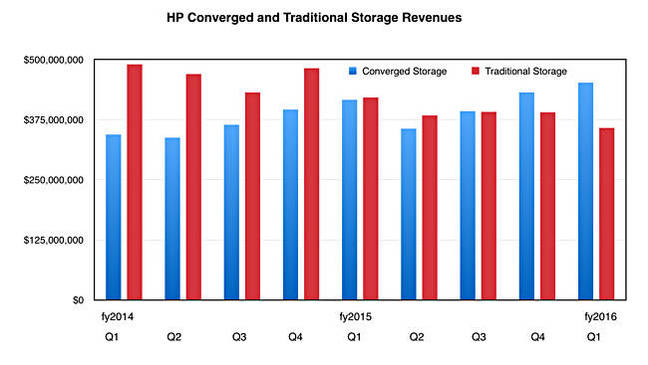

We charted the progress of HP/HPE’s converged and traditional storage revenues to show what’s happened too, with converged overtaking traditional product revenues:

The converged-traditional storage revenue gap is increasing.

In HPE’s latest quarter we’re told the StoreServ (3PAR) product line's all-flash revenues grew at 100 per cent plus year-on-year. The rest of 3PAR didn't grow so much. In the earnings call, CEO Meg Whitman said: "We had record revenue for 3PAR, driven by triple-digit constant currency growth in all-flash, which grew at three times the market rates."

CFO Tim Stonesifer said: "3PAR all-flash grew triple digits again, driving 3PAR revenue growth of 21 per cent year-over-year in constant currency."

Stifel Nicolaus MD Aaron Rakers, an analyst, talked to HPE and later wrote, in a note for clients: "Our discussions with HPE also noted that their all-Flash 3PAR revenue totalled ~$155-$160m, growing 125 per cent year-on-year."

The other converged storage products, such as StoreOnce Backup, StoreAll, and StoreVirtual, must then have done commensurately less well, if they did well at all. How you get from 21 per cent product component growth to 8.7 per cent business unit growth means lower or no growth in the other converged product lines, such as deduping backup arrays (StoreOnce), object storage (StoreAll) and virtual SAN/converged (StoreVirtual), which dragged the overall result down.

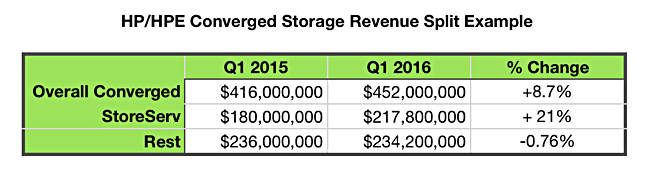

Playing with numbers can illustrate this. Based on converged storage revenues of $452m in Q1 FY 2016, $416m in Q1 FY 2015, and $157.5m all-flash 3PAR in Q1 FY 2016 (Rakers' mid-point) and assuming $217.8m overall 3PAR revenues that quarter, then StoreServ revenues were $180m a year ago and grew 21 per cent to $217.8m in Q1 FY 2016, and the remaining converged storage products did $236m in Q1 FY 2015 and declined 0.76 per cent to $234.2m in Q1 2016.

The table shows this example worked out:

In general, StoreServ is flying while the others are holding HPE converged storage back. Hopefully the HPE-Scality deal will re-ignite HPE’s object storage growth, since StoreAll seems to have become StoreNotQuiteEnough.

It appears that HPE storage has one main growth product in StoreServ and needs more, hence the recent move into partnership with Scality, set up by HPE’s head storage exec, Manish Goel, who was appointed a year ago.

The coming hyper-converged infrastructure appliance (HCIA) presaged by Meg Whitman in the Q1 2016 results earnings call is another attempt to grow revenues.

This will follow from from HPE’s Converged System 250 aka Azure-in-a-can announced last December.

As HCIA’s are server-centric and run storage software their revenues may not be included in HPE’s storage segment in its Enterprise Group organisation.

One more point; HP seems confident it can cover its flash storage needs from the single 3PAR product line; a different approach from that of EMC and NetApp. It will be interesting to see if this line holds until its memory/non-volatile memory-centric Machine hits the streets . ®