This article is more than 1 year old

Quantum sells so much product that its earnings might shrink

Sales force did well – but too late for the beancounters

Quantum says it will make lower revenues than expected this quarter because it sold too many products and its supply chain couldn't keep up.

How does that work?

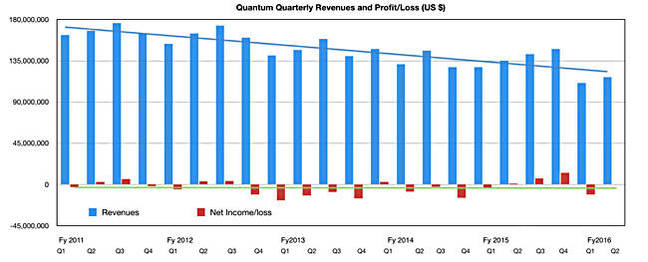

The data centre equipment firm thought its revenues for its second fiscal 2016 quarter, which finished on September 30, were going to be between $120m and $130m.

Now it thinks they will be between $116m and $118m, or 6.4 per cent lower.

Quantum's sales force, it says, had "an unusually high number of customers placing orders in the last three days of the quarter," particularly in scale-out storage (StorNext). Its disk suppliers couldn't ship enough drives to fulfil all these orders, which will now ship, and be billed, in the next quarter.

This means that the second quarter revenues, viewed in a year-on-year comparison, will be 13.4 per cent lower than a year ago. They would have been down 5.3 per cent if the revenue expectation mid-point had been met. In El Reg's storage desk's view, there has to be a likelihood that the second quarter will be loss-making for Quantum as a result.

The scale of the second quarter end backlog is massive; approximately $8m to $9m, compared to the company’s typical quarterly backlog of approximately $1m.

The wordwide sales boss can't be a happy bunny and his CEO, Jon Gacek, won't be pleased either. ®