This article is more than 1 year old

Disk is dead, screeches Violin – and here's how it might happen

Death by NAND acronyms: 2D MLC, 3D TLC, 3D QLC

Disk drive death stages

First, we can see that the cost and endurance of 3D TLC NAND could kill off the next tier of disks, the 10,000 rpm, 2.5-inch spindles, today. Such NAND would possibly have a lower cost/raw TB than 15K disks and a lower cost/deduped TB than 10K drives. Accept that as a possibility and let me lead you further from your disk comfort zone.

The remaining 7,200rpm 3.5-inch bulk capacity disk drive segment will be eaten into by 3D QLC flash. The extreme view says deduped 3D QLC flash will kill off 7.2K disk drives.

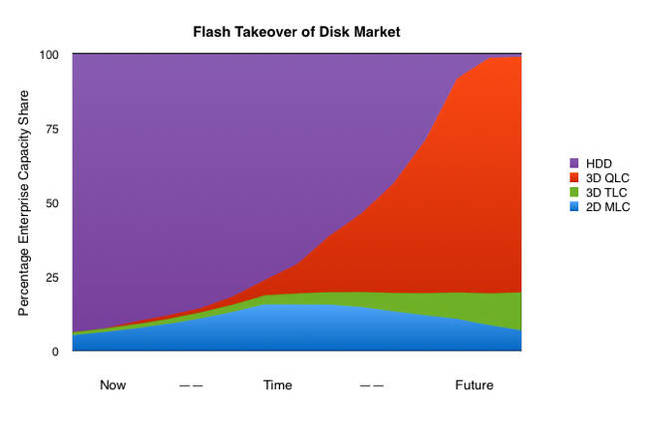

We can show this sequence of disk drive death stages graphically:

Possible scenario showing flash takeover of disk market

Again, please don’t look at the exact shape of the curves: we’re showing a general concept here with an imprecise time line and roughly approximated curves.

So this scenario is how Violin’s notion – that disk is dead in the enterprise data centre – could come about.

Effect on disk drive suppliers

If you agree that this general idea has legs, then we can run further still. If you don’t, then by all means read along anyway and tear the argument to bits in the comments afterwards.

Violin’s strategic flash supplier is Toshiba. Therefore, my extrapolation from this fact is that Toshiba is influencing Violin’s view of likely 3D TLC and 3D QLC flash properties and effects.

Further, since SanDisk partners Toshiba in flash foundry activities, it is as aware of these 3D TLC and 3D QLC flash properties as Violin is.

Here’s a question. How does this affect the two disk drive suppliers: Seagate/Samsung and WD/HGST?

We’ll note that these two pairs of companies are in a suspended state, because China's MOFCOM regulator won’t let them merge into single Seagate and Western Digital companies.

If the Toshiba/Violin disk-is-dead scenario is correct, then Toshiba is better placed than either Seagate/Samsung or WD/HGST, because it has a flash foundry operation as well as a disk drive operation. Therefore, to survive and to maximise their business potential, both Seagate/Samsung and WD/HGST will have to strengthen their slowly-developing flash component business operations (PCIe flash cards, SSDs and controllers) by getting into a strategic relationship with a flash foundry operator or buying one.

The view is that they need a close relationship to develop component products, using emerging flash technologies, as fast as Toshiba/Violin and SanDisk, or be left behind.

Who could they ally with, or buy?

Dating with flash foundries

Not Toshiba or SanDisk, obviously, as Toshiba owns 10 per cent or so of Violin, partners with SanDisk, and is not available. The big flash foundry players are Intel and Micron, with IMTF, and Samsung. Hynix is a smaller player. We could take the quick and rough view that Hynix is small enough to be bought, but the main players are Micron and Samsung.

As Seagate is already close to Samsung, we here at El Reg Flash Fantasy desk could see a Seagate/Samsung pairing developing and also a Western Digital (meaning WD and HGST)/Micron pairing via a joint-venture, for example – were it not for MOFCOM.

Noting that China wants to develop its own semiconductor industry with DRAM and flash components, then it is not in China’s strategic flash industry interest for MOFCOM to allow a WD/HGST merger. That could lead to a Western Digital-Micron joint venture, resulting in a global flash giant. This could inhibit an indigenous Chinese flash foundry from growing as strongly as it might otherwise do.

Better, from that point of view, to have MOFCOM prevaricate and keep WD and HGST separate and so prevent a new flash giant from emerging. Ditto, to an extent, preventing Seagate merging with its acquired Samsung disk drive operation, and so keeping Seagate and Samsung as far apart as possible.

This near-conspiracy theory only makes sense if the idea that flash will kill off data centre disks makes sense.

In general, Violin Memory thinks it does, and is moving from a tier zero to a tier one flash array product strategy as part of that thinking. What do you think? Will 3D TLC and 3D QLC flash kill off the data centre disk drive market?

Answers on a postcard please, to Steves Luczo and Milligan at Seagate and Western Digital respectively. ®