This article is more than 1 year old

Martinwolf: The state of the tech industry in Q1 2015

Roll up, roll up, get your exclusive market insights

India and China: Sitting on the periphery, but for how long?

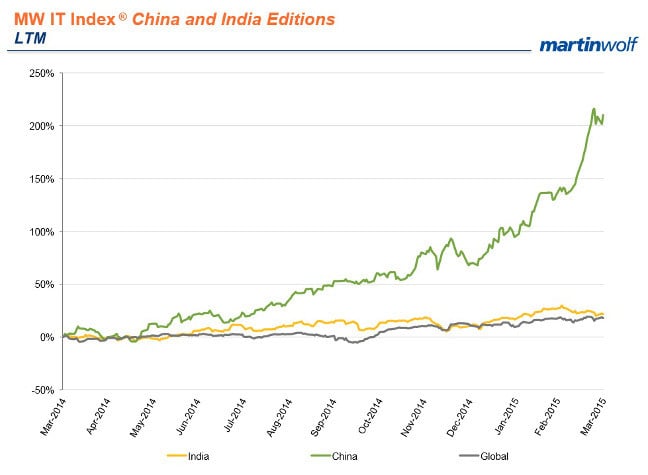

Our India and China Index graphs are by now a familiar sight. Chinese stock market performance continues to grow, while the more modest Indian and Chinese IT Services markets look like they belong on a different graph altogether. It’s March 11’s dramatic rise that takes the MW IT Index (China Edition) from strong to stratospheric.

Martinwolf IT Index India China

Thanks to China’s major stimulus policies and its central bank lowering interest rates, it has been an eventful quarter for the Shanghai Composite Index, where many of the stocks on the MW IT Index (China Edition) are traded. Despite the country’s economy showing signs of a slowdown, IT stock prices have gone up significantly — the China Edition of the Index is up more than 100 per cent. Many IT leaders are optimistic that they may actually benefit if a slowdown forces the Chinese government to invest in modernizing technology and infrastructure.

This year also sees a major opportunity for Indian IT Services companies, who should use this time to move up the value chain beyond their current offerings. Capability and cost gaps are fast closing with major global competitors like IBM and Accenture—in order to compete, Indian firms need to undergo significant, transformational M&As to solidify their advantage. Remaining ahead will require identifying specific industry opportunities and filling those niches. And this requires significant commitment—one cannot achieve vertical or horizontal superiority through a series of small acquisitions.

One area of potential value growth where we’ve seen strong interest is in digital strategy. Any successful digital practice has three key components: a clearly articulated overall strategy, polished customer experience management capability and a strong technological foundation. Thanks to their experience in the IT space, Indian firms already possess this strong foundation. But thanks to cultural differences and a need for polished front-end capabilities, top Indian firms have traditionally lacked in digital strategy, design and delivery.

Ensuring continued success in an industry as dynamic and fast-moving as IT will not come cheap, but is more important now than ever before as clients increasingly demand multichannel offerings beyond the traditional web-based or brick-and-mortar firms. The right acquisition strategy today will pay dividends not just for 2015, but for the future to come. ®