This article is more than 1 year old

QLogic and Emulex struggling to escape Fibre Channel woes

Will the uptick in both firms' financials pull them through?

Whither Emulex, fair maid?

Emulex also has a relatively new CEO, Jeff Benck, but he is not producing such good results as Jean Hu. The company also has activist investors breathing down the CEO's neck.

Revenues for its second fiscal 2014 quarter, ended December 29, were $123.0m, up from the prior quarter's $114.8m and the year-ago quarter’s $122.1m. Profits though, rather losses, showed a $4m dive into red ink this quarter, a slightly deeper dive than last quarter's $3.6m loss. A year ago the company was posting profits of $5.6m.

What did the company say about this? “I’m pleased to report that we once again exceeded the high-end of our earnings guidance,” said Benck, “and have made significant progress on our three-part initiative to increase shareholder value.”

This 3-part initiative involves:

- An expanded program to deliver $30m in annual cost savings compared to the fiscal 2013 spending level in the connectivity business. The program includes a 15 per cent workforce reduction and the closure of the Bolton, Massachusetts engineering facility by the end of fiscal 2014

- A $200m share repurchase program, of which $100m is expected to be completed by the end of May 2014 primarily funded by completion of a $175m convertible debt offering due in 2018

- Receiving acceptances from three new people who will be seated as independent board members at the upcoming shareholders' meeting on February 6

So Emulex is still stuck in the mire and trying to climb out while finding money to satisfy the financial pangs of the activist investors.

Rakers found some good news in Emulex’s numbers, with revenues being the highest in five quarters. He reckoned there was a 12 per cent sequential increase in Network Connectivity revenue versus a five per cent increase at QLogic. There are still likely to be costs stemming from the Broadcom legal action and the Ethernet fabric monitoring technology from Endace did not do as well as Rakers expected.

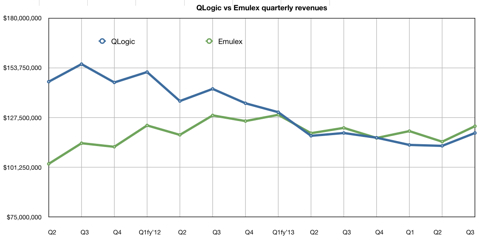

Comparing QLogic and Emulex's quarterly revenues ,we can see they are now travelling in lock-step:

Of course, QLogic has been profitable for the past few quarters while Emulex has not. QLogic’s bet on its escape from a maturing Fibre Channel adapter market with the Mount Rainier technology looks like it could be an underperforming business. Emulex bet on Endace to carry out a similar task but has yet to show that was the right bet to make.

So QLogic needs a permanent CEO and a new strategy while Emulex’s new CEO is battling with activist investors on the board who probably want to sell the company.

It’s not all fun in storage networking adapter land, not at all. ®