This article is more than 1 year old

Flash: Fibre Channel drives poised for the exit

In the year 2012

In just 30 months flash solid state drives will cost only three times as much as Fibre Channel drives, prompting a user switchover to flash, according to Wikibon analyst David Vellante.

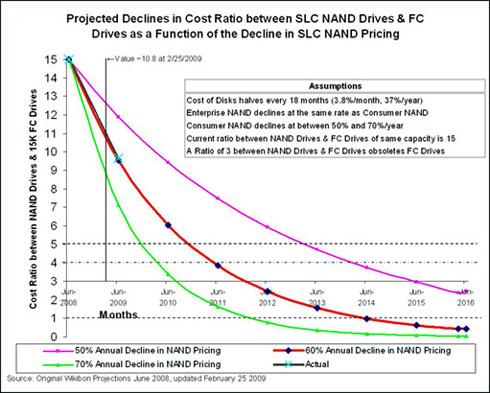

He plotted three price erosion curves (below) for single level cell flash over the next few years, expressing the cost of flash as a ratio between it and 15,000rpm Fibre Channel disk drives, the ones used for providing the fastest access to disk-stored data. The curves were for 50, 60 and 70 per cent declines in SLC NAND flash pricing. He made the assumption that enterprise NAND flash prices will decline at the same rate as consumer NAND and started his curves at June, 2008, extending them out to June 2016.

He added a line for actual NAND price declines so far, and this tracks the 60 per cent decline curve.

Vellante argues that, when NAND SSDs are only three times more expensive than Fibre Channel drives then, because flash drives are so much faster to access, not having to wait for a disk read/write head to be moved to the target track holding the data, users will start switching.

Currently customers will use flash in preference to short-stroked Fibre Channel drives where the cost/GB is much higher because the drive's capacity is effectively reduced. Data is placed on the outside tracks of such drives to reduce the head seek time.

As NAND prices drop, Vellante argues, customers will start putting fast access data in flash and the remaining data on SATA or SAS drives. His chart predicts this will happen in early 2012, with a 60 per cent annual drop in flash prices.

Effect on HDD manufacturers

What will this mean for hard disk drive vendors? Seagate is the leading shipper of Fibre Channel disk drives with Hitachi GST and Fujitsu also making them. Western Digital, the number two disk drive manufacturer, does not make Fibre Channel drives.

Seagate has already seen a 33 per cent drop in the total addressable market for enterprise drives in its most recent financial report, but this could be be recession based. It's generally reckoned that Seagate makes most of its profit from FC drives and if this product faces declining sales from 2012 onwards then Seagate profits will be hit.

The same is true for Hitachi GST and for the Fujitsu HDD business which is currently being bought by Toshiba. All three vendors will have to offer enterprise flash drives in order to stay in the enterprise data storage business. Seagate has said it is going to and may announce its first SSD product later this year. Western Digital has just bought an SSD technology company, SiliconSystems, and has said it will supply SSDs to the enterprise market.

HItachi GST has also said it will start shipping SSDs at some stage, and Toshiba already makes SSDs, having a joint venture with SanDisk, although not supplying the enterprise market.